This article is based on statistics extracted from Infosource’s database (isDB), available under scalable subscription to match your exact research needs.

In EMEA, the label press (digital color press continuous feed) market has shown a remarkable recovery in H1 2021 after the pandemic disruptions of 2020. This recovery is shown by increases in both unit sales (49%) and revenue (51%) compared to H1 2020. Considering the top 5 markets in the EMEA region (Germany, Italy, France, United Kingdom, and Spain) accounting for 60% of total unit sales in EMEA in H1 2021, the trend was similar.

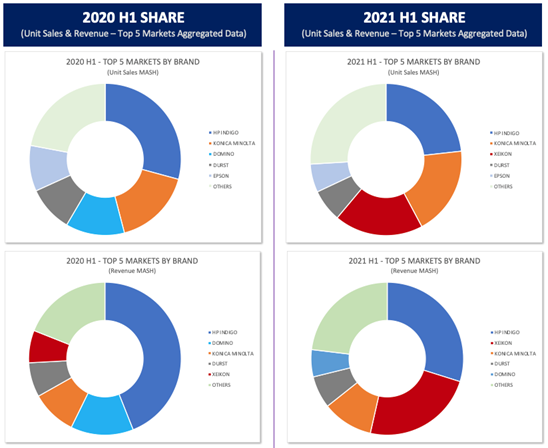

Within the top 5 EMEA markets, unit sales increased by 61% in H1 2021 vs H1 2020, and by 16% vs H1 2019. Germany and the United Kingdom had the highest growth in total unit sales. Amongst the top brands in unit sales for H1 2021 we saw HP Indigo, Konica Minolta, Xeikon, Durst, and Epson account for 74% of total unit sales. In revenue terms we saw HP Indigo, Xeikon, Konica Minolta, Durst, and Domino account for almost 77% of total revenue in H1 2021. AccurioLabel 230, Press 6K, and Xeikon CX50 were the top-selling models for H1 2021.

Barring unexpected disruptions in these five markets over Q3 2021, we expect the top 5 EMEA markets to exceed FY 2019’s unit sales by over 7% at the end of 2021. This will be reflected with an increase in Full Year Print Volumes (FYPV*) at the end of 2021, expected to reach at least 1,600,000k FYPV. HP Indigo, Konica Minolta, and Screen are currently the top brands in print volumes with their high-production devices. FYPV is based on Infosource’s best estimate of Average Monthly Print Volume (AMPV) per model.

The label press industry seems to have been unaffected by the pandemic over the last 18 months for three primary reasons. The first, many companies in the healthcare, retail, warehousing, food and beverage, cosmetics, and logistics sectors had to change their model and boost or develop their online business. This increased the demand for label press installations.

Secondly, additional demand emerged for Covid-related products and printed label stickers of all sizes. For example, the need for stickers for social distancing didn’t exist pre-pandemic and is expected to remain till the pandemic is over.

Finally, there has been a trend to a higher level of customization. More customization means shorter runs for digital label press applications. We expect this trend to continue and drive growth for the digital label printing industry at least through 2024.

The Rise of Inkjet Technology in Digital Label Printing

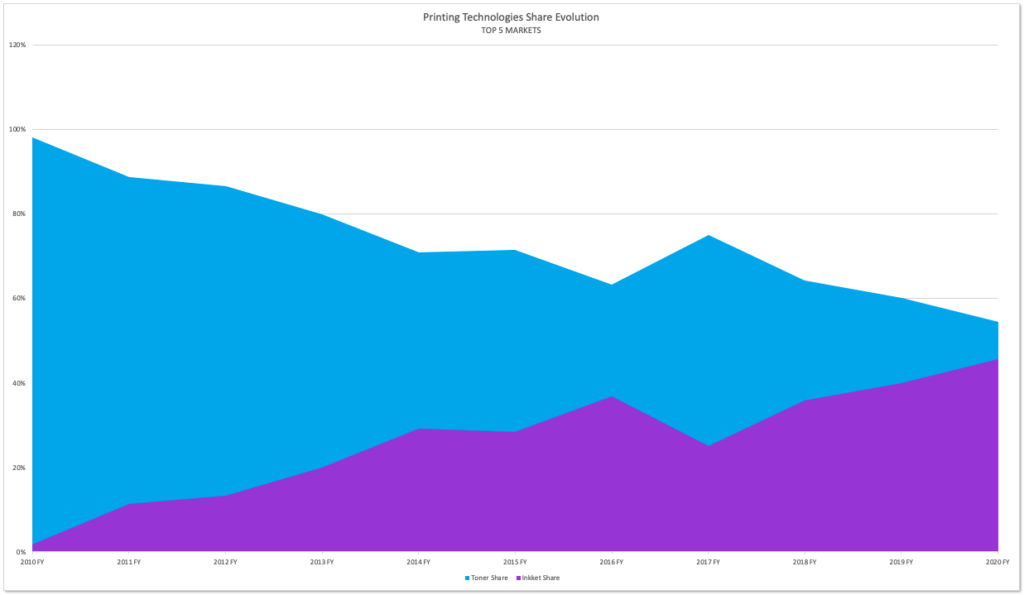

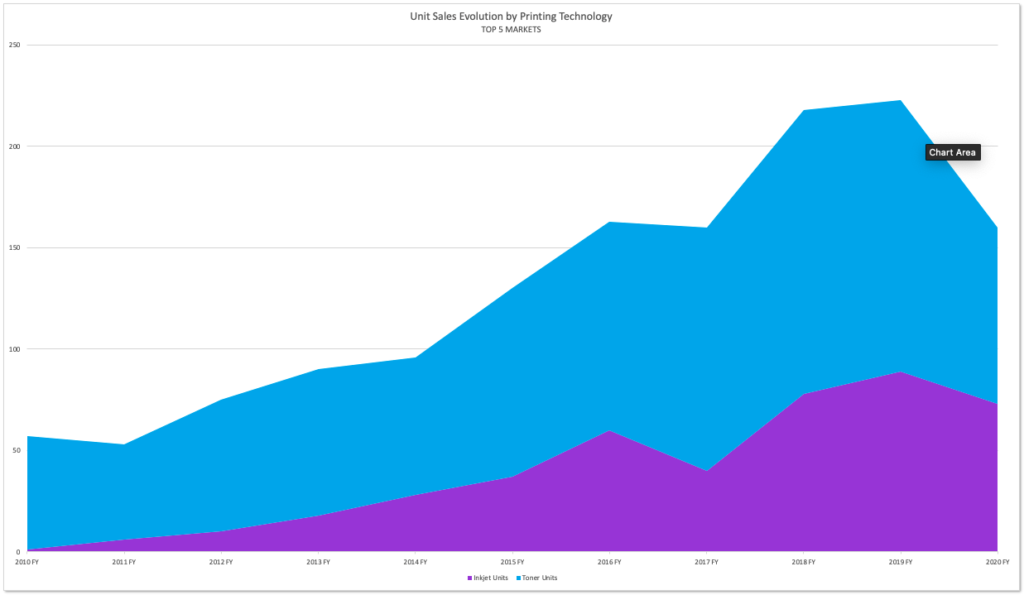

Over the last decade we’ve observed the disruptive force that caused the eruption and progressive adoption of inkjet technology within the label press market. In 2010 almost 100% of the market was dominated by HP Indigo and Xeikon, with their respective toner-based technologies. Since 2010, the number of inkjet vendors and placements has continuously increased across the analyzed region, accounting for over 45% of total unit sales at the end of 2020.

Key factors behind this upward trend include:

- Rapid evolution of inkjets in terms of printing quality and speed.

- Progressive reduction of the digital ink’s prices, in combination with their improved technical properties.

These factors have drastically increased the profitable digital run lengths versus flexography, making inkjet technology very attractive for new investments in the label press market, either for a purely digital label printing environment or in parallel with analogue technologies.

Label Printing in 2022 and Beyond

Looking ahead to 2022, the digital label press market in the EMEA region is expected to grow 8-10% in unit sales. Similar increases are projected year after year through 2024.

Our report was compiled in part with insight based on face-to-face meetings with key market players and experts. Below are highlights from some of these conversations.

DURST

Mr. Thomas Mancina, Global Sales Manager for the Label and Flexible Packaging Division at Durst Group

What is your opinion about the existing printing technologies and their evolution in the future?

Mr. Mancina: I believe that inkjet will represent the majority of new installations, for the upcoming years, in mature markets. Why? Ten years ago, toner was the only technology that could address the customer needs, mainly providing a solution for high-quality short runs on numerous types of substrates to free up the conventional capacities and develop new markets. Nowadays, this is a standard and can be achieved with most of the digital solutions, however new and additional needs arose over the last years which inkjet technology can address better than toner technology: reliability (digital became a significant part of my business, it can´t fail!), ease of use (it’s becoming a real challenge to find qualified operators!), productivity and cost effectiveness (I want to offer digital also for long runs, actually for all my jobs!).

SCREEN

Mr. Bui Burke, Senior Vice President Sales, Dainippon Screen Europe

What is your personal vision regarding the future expansion of the digital label press market?

Mr. Burke: It is widely accepted that at some point in the future virtually all printed products will be printed digitally. This is going to be a long, slow transition though. Whilst the benefits of digital production are clear and persuasive: integrated processes, clean technology, easy to use, exact quantities – reduced waste, on-demand production, etc. So, to simply answer the question, we can see how all the metrics of digital presses improve over time – speed, quality, capabilities, and also running costs. As they do, the displacement of conventional presses and processes continues. Screen are long established in the commercial printing world (the area where the most opportunities exist for high-end equipment manufacturers) and we are experiencing increasing interest in our products and making more installations than ever before. We are developing exciting and powerful devices designed for many applications so I can confidently predict that digital press sales will continue to be strong and continue to grow for many years.

XEIKON

Mr. Frank Jacobs – Market Intel & Senior Product Manager at Flint Group´s Xeikon

What is your personal view on the digital label press market?

Mr. Jacobs: We clearly see how digital printing is gaining more and more momentum versus the traditional analogue technologies. Year over year, we can observe how digital systems are more capable of doing the same things, or even more, than the flexo equipment. For example, if you compare the entire printing process, today’s faster inkjet systems can already offer final output levels comparable to what flexo printers can deliver. The increasing digital systems performance, together with the clear global trend towards higher automatization and integrated and digitally-controlled workflows, will accelerate digital printing sales in the coming years. Of course, the flexo technology will not disappear. But I think that we will consistently see how, year over year, it loses market share against digital systems. In our opinion, more and more we will see labels production plants based on the most efficient and automatized combination of flexo, digital toner, and digital inkjet technologies.

Infosource

Finally, we asked Mr. Johann Hoepfner – Managing Director at Infosource – for his vision regarding the current situation and evolution for the Label Press industry:

Mr. Hoepfner: We are satisfied to see the Label Press industry, after a noticeable 20% decline in 2020, not only recovered but predicted with significant growth even compared to 2019. Improved technologies open the way to new applications every year. Infosource is proud to support the industry with detailed and timely analytics in their strategic decisions to build on trends and create new opportunities.

Authors of this report are:

- Eirini Louizou, Senior Analyst, Industrial Printing, [email protected].

- Rodrigo Lopez Parte, Regional Manager, [email protected].

About Infosource

Infosource has achieved broad industry recognition by tracking the digital print industry with unequalled precision, offering a unique level of detail, accuracy and reliability. Our reports are supported by extensive local field research, conducted through regular face-to-face interviews with all major and most minor players of each industry segment, making Infosource the preferred market data supplier in the Production & Industrial Printing industry.