By Petr Kramerius, Regional Manager at Infosource

The European inkjet market continued to decline in the first half of 2024, even as inkjets continued to erode the market share of laser printers. With the printing speed gap between inkjets and lasers continuing to close, inkjet technology is suitable for broader applications, including office environments and commercial printing services.

High-speed inkjet printers are now available and capable of producing large volumes of prints quickly, efficiently and cost-effectively. Modern inkjet also has the advantage of offering eco-friendly features such as energy-efficient designs, the use of water-based inks, and the ability to print on recycled paper.

These advancements reduce the environmental impact of printing while maintaining high-quality output—aligning with the drive towards sustainability. Toner/laser devices use 85% more energy than inkjets. Some manufacturers plan to leave the laser market due to environmental concerns—Epson, for one, plans to stop selling laser printers by 2026.

Inkjet technology has become increasingly cost-effective, both in terms of initial printer costs and ongoing operational expenses. The availability of affordable inkjet printers, improved ink efficiency, and the ability to print on both sides of the paper (duplex printing) contribute to cost savings for businesses and individuals alike.

From improved print quality and speed to enhanced versatility, eco-friendliness, and connectivity options, inkjet printers have evolved to meet the demands of today’s dynamic printing landscape. Despite the decreasing trend, they will continue to exert intense pressure on the toner/laser printing segment. Let’s take a closer look at our sales data.

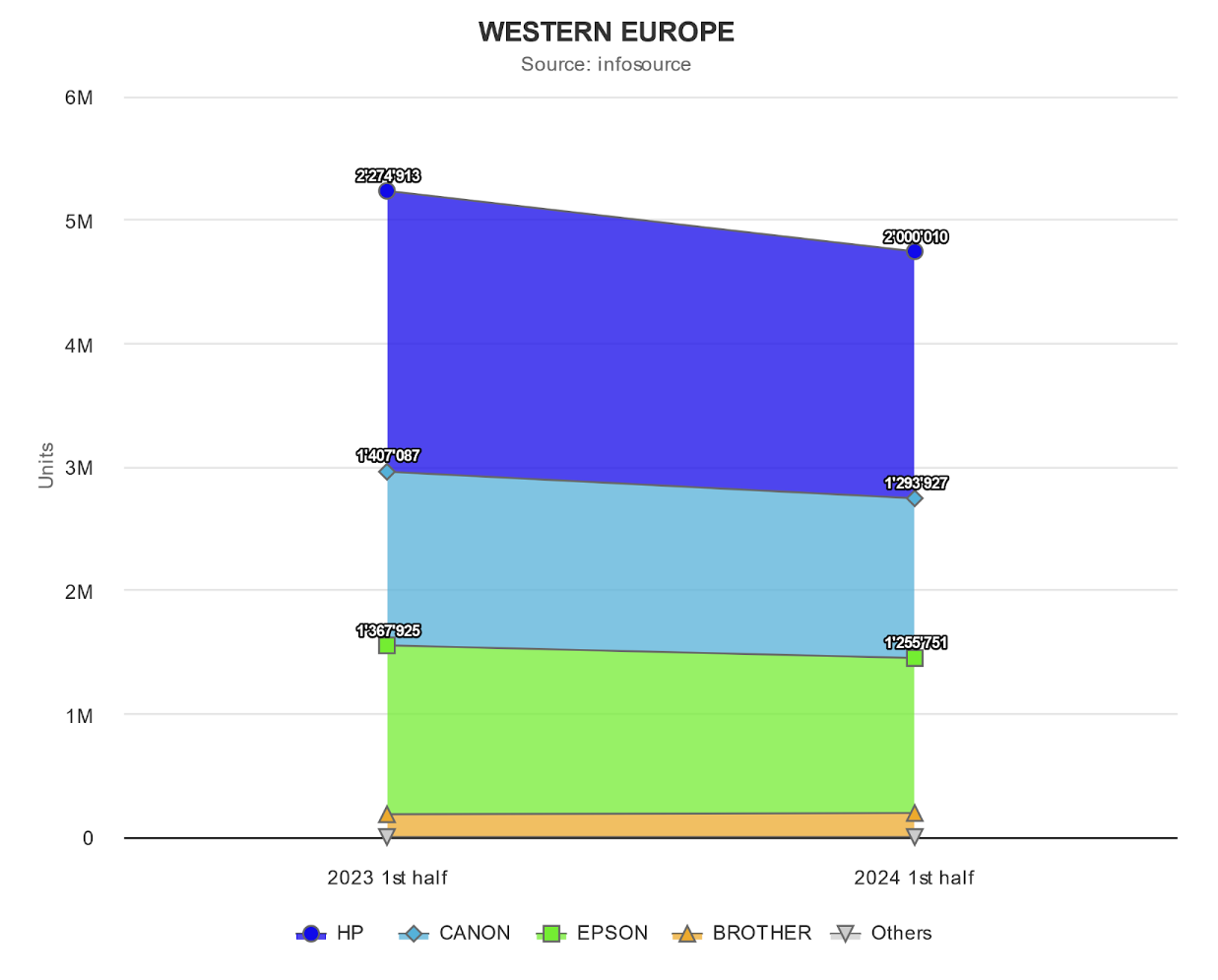

Western Europe inkjet sales dip 9%

The Western European inkjet printers market decreased 9% in the first half-year of 2024 to around 4.8 million units compared to the same period in 2023, with most countries registering declines. The total inkjet printer market in H1 2024 remain significantly larger than the laser/toner copier/MFPs market in the region.

Only Greece (up 4%), Ireland (+22%) and the Netherlands (+9%) defied the downwards trend. France, the largest market with a 21.9% share, saw a 3% drop. The UK (17.5% share) overtook Germany to become the second largest market, despite a decrease of 7%. Germany (16.9% share) was down 17% and Italy saw a 22% decline.

Multifunction (MF) inkjet printers declined 9% and accounted for 97% share of inkjet sales in H1 2024. Single-function (SF) inkjet unit sales decreased by 21%. The home/consumer personal market (around 3.4 million units) went down 13%, while the business market was flat at 1.3 million units. The business market’s share of the total inkjet market was 28%.

The ink tank market (CISS – Continuous Ink Supply System) increased by 5% to about 1.2 million units. Inkjet A3 sales—an important market from a revenue point of view—registered a decrease of 27%, with sales growing only in Belgium. Within the A3 inkjet market, CISS printers achieved a 7% market share.

Brands maintained the same position in the market as they did in H1 2023. HP retained its number one position (41.1% market share), despite a 12% decrease in unit sales and a 13% drop in home/consumer personal sales. Canon’s total unit sales were down 8% in H1 2024 and its market share was 27.3%.

Epson’s total market share remained at the same level of around 26% in H1 2024, despite a sales decrease of 8%, with its home/consumer personal inkjet sales falling 19%. Brother’s market share improved slightly to 4.1% in H1 2024, supported by a 6% sales increase, one of few vendors to increase unit sales during the period.

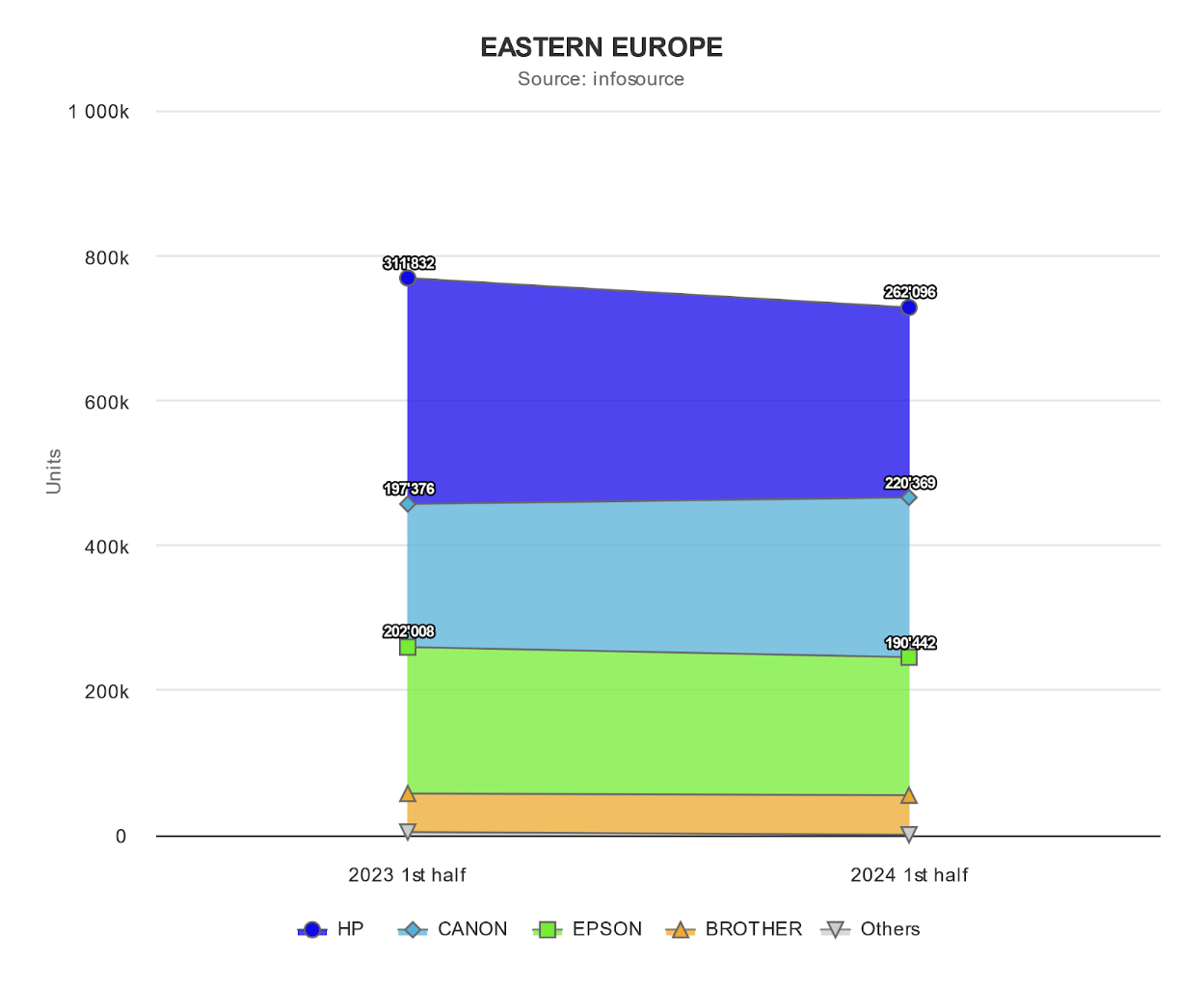

Eastern European sales see 5% drop

The Eastern European inkjet printers market in H1 2024 decreased by 5% to around 728,000 units and was slightly larger than the region’s total toner copier/MFPs market. Most countries markets registered decreases, except for the Czech Republic, Romania, Bulgaria, Lithuania, Georgia and Bosnia.

Russia, formerly the largest market, fell to 21st place out of 25. This was due to Western brands exiting the market—most of the new brands that replaced them don’t offer inkjet models. It’s worth noting this accounts for official sales only, since parallel imports remain available. Excluding Russia, the market declined 3.5%.

The largest market, Poland (35.9% share), decreased by 9%, followed by the Czech Republic (17.6% share), which registered a growth of 3%, and Romania (11.2% share), which registered the highest increase of 44%. In fourth place, Hungary (5.3% share) declined by 11%. Ukraine shrank by 20%.

The multifunction (MF) inkjet printer market contracted by 3% and represented 94% of the total inkjet market, while single-function (SF) printer sales dropped 20%. The home/consumer personal market in H1 2024 declined by 7%, while the business market expanded 17%. The ink tank market was up 3% and the inkjet A3 market declined 26%.

HP retained its number one position in the Eastern European inkjet market, despite a 16% reduction in unit sales in H1. Supported by a 12% sales increase, Canon overtook Epson in second place, while Epson in third reported a 6% sales decrease. Brother’s market share increased to 7.5%, supported by a slight unit sales increase of 3%.