This article is based on statistics extracted from Infosource’s database (isDB), available under scalable subscription to match your exact research needs. It was published in the original Spanish by AP Digitales – N. 62. You can read the original by clicking here.

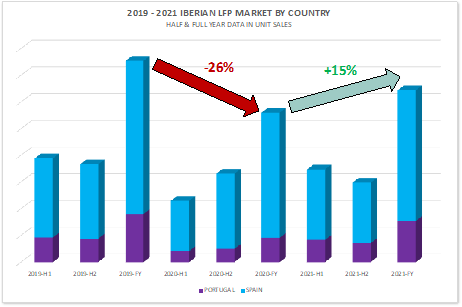

From 2017 onwards, the Iberian Large Format Market (LFM) started a consolidation stage, remaining stable and almost flat in both unit sales and revenue for the period 2017-2019. In 2020, the disruption caused by the pandemic, which hit the southern European countries especially hard due to their weaker economies and the bigger exposure to the economic sectors more affected by Covid-related restrictions, made the LFP Iberian market decrease by almost 26% in unit sales and by more than 26% in revenue compared to 2019 figures.

From 2020 2nd Half onwards, the Iberian LFP market began to show a recovery trend that continued in 2021. By the end of 2021, the market showed a 15% increase over 2020 FY period, in unit sales. However, in Iberia, contrary to the overall Western European scene, the pre-pandemic levels are not yet recovered but expected to in the next 2-3 years.

It is expected that the worldwide logistics and supply problems that are causing shortages in almost all technology industries will also affect LFP market sales along 2022 H1 period. However, it is foreseen that the supply limitations will be overcome within the first six months of 2022 and most of the main vendors trust in their capability to balance the sales and fulfill all pending backorders during the second half of the year.

The Iberian LFP Market by Applications: CAD, Graphic, and Textile Segements

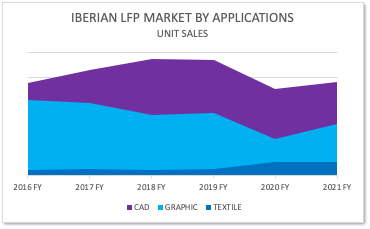

If we look now into the different main LFP applications – CAD, Graphic, and Textile – we can observe different behaviors, trends, and recovery rates after the pandemic crash.

Different behaviors can be also observed between Spain and Portugal. While the LFP Portuguese market crashed more strongly in 2020, its recovery rate in 2021 was also much higher than that shown by Spain. However, by the end 2021 both countries showed figures that still are around 15% lower than 2019 sales.

CAD Market

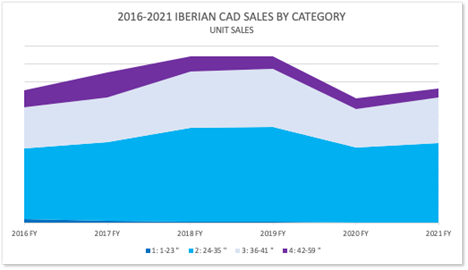

The CAD market accounts for around 60% of the total LFP unit sales across the Iberia region; almost six percentage points below the Western European average CAD market share. Considering Spain and Portugal together, the CAD segment was able to keep a continuous growth trend, in unit sales, until FY2018 period, remaining almost flat in FY2019 and showing a 25% decrease in FY2020 due to the pandemic lockdown and subsequent restrictions.

By the end of FY2021, this market showed a 7.7% growth rate, followed by a very smooth growing trend up to 2025 supported by the 13% forecasted growth rate for the Spanish construction industry in FY2022. Additionally, and depending on how the Spanish and Portuguese governments will finally distribute the released European Public Recovery Funds, the aforementioned smooth growth trend could be pushed up and accelerated.

Graphic Market

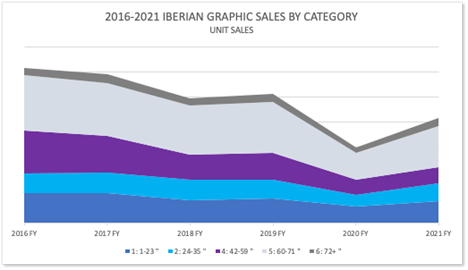

By the end of FY2021 period, the Graphic Arts segment, including the soft signage, will account for around 32% of the total Iberian LFP market. After a remarkable long-term growth trend, this segment hit its maximum figure (over 3K units) back in 2016, starting then a downtrend until going below 1.5 K units in FY2020 and thus decreasing by almost 42% compared to the FY2019 period.

This huge decrease is well explained due to the big dependency of the Iberian Graphic Arts Market from the hostelry, tourism ,and other mass events-based economic sectors. That high dependency on certain specific sectors also explains its slower recovery compared to other neighbor countries. For FY2021 vs FY2020, the market showed a 39% increase in this segment. However it is not expected that the highest pre-pandemic figures will be reached again in the near future.

Regarding ink technologies, the most noticeable trend is the progressive market share reduction for solvent printers, due to the increasing environmental concern and regulations that we can observe throughout all main European countries. Conversely, the UV curing printers showed the highest MASH increase along the last 5 years period.

Textile Market

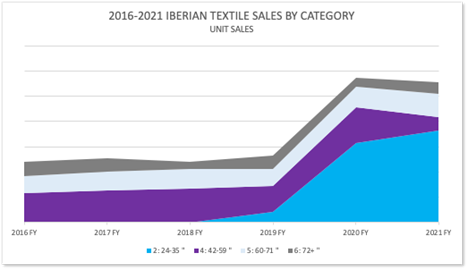

The Digital Textile Printing segment is a clearly growing application within the Large Format market across all of Europe and the Iberian region is not an exception. Even the pandemic was not able to stop the growing trend – rather it accelerated it.

By the end of FY2021, the LFP-Textile is projected to account for almost 9% of the total LFP unit sales across Iberia. Although this is still a small segment in unit sales, its revenue is relatively higher and will almost account for over 16% of total Iberian LFP market value by the end of this year (last year 2020, even accounting more units than in 2021, it was only the 14%). For the upcoming years, Infosource expects a continuous growth trend that will make the market almost double, by 2025, the 2021 reported unit sales.

About Rodrigo López Parte

Rodrigo López Parte ([email protected]) has a more than 20 years background in marketing and sales responsibilities within various professional digital printing markets. Along his career, Rodrigo has had the opportunity to work in different market segments such as the industrial photo market, the graphic arts large format printing, the industrial ceramic and textile printing and the digital packaging finishing. From February 2021, Rodrigo joined the Infosource’s team as market analyst and regional manager for Iberia and North Africa.

About Infosource

Infosource has achieved broad industry recognition by tracking the digital print industry with unequalled precision, offering a unique level of detail, accuracy and reliability. Our reports are supported by extensive local field research, conducted through regular face-to-face interviews with all major and most minor players of each industry segment, making Infosource the preferred market data supplier in the Production and Industrial Printing industry.