KEY TAKEAWAYS

- This vertical market assessment is an integral part of Infosource’s analyst services in the Software practice. We analyse industry sectors in key countries around the world and leverage this knowledge in the regional forecasting of the Capture & IDP market.

- While the digital maturity of all industry sectors has improved as result of emergency digitalisation actions during the pandemic, most organisations yet have to establish a comprehensive strategy that meets the changing requirements in their sectors; in most industries those include growing importance of customer experience, lack of skilled staff, fraud, and cybersecurity threats, growing sustainability concerns and regulatory mandates.

- At the same time the digital divide continues to widen, leaving geographies in less wealthy emerging markets, and in particular in rural areas further behind. The lack of Telecoms infrastructure and digital skill development presents a hurdle; however, where investments by local government or overarching organisations close the gap, they will enable in particular economies with young populations.

- The Finance sector, led by Banks and Financial Institutions, has been at the forefront of embracing technologies. We expect this sector to be at the forefront of embracing Advanced AI technologies to further enhance customer facing processes with a strong focus on Customer Experience. Generative AI solutions present an important opportunity for the integration in IDP solutions.

- We also expect IDP solutions leveraging advanced AI technology and offering low code capabilities to lower the barrier for the adoption of digital automation solutions. For example, organisations in the Legal and Retail sector may see impressive ROIs.

- BPOs with advanced skills have the opportunity to position themselves as AI technology hubs and advisors especially in the coming learning phase, as privacy aspects are addressed, regulations are catching up and business models are being refined.

- The Public Sector plays a multi-faceted role in digital transformation. Except for a few exceptions like the UAE and China to a certain extent, in most geographies the Government sector is in an earlier stage of maturity. The pace in which governments in the respective geographies address infrastructure gaps, accelerate legislation in particular related to the deployment of AI technologies and prioritise the digitalisation of their own processes, will be a major gate keeper for the advancement of the digital maturity in the respective geographies.

VERTICAL MARKET FRAMEWORK

Infosource defines the Capture and Intelligent Document Processing (IDP) Software market as solutions and services used to ingest and process business inputs which involve semi-structured and unstructured documents and other input types. These solutions are designed to acquire, classify, validate, and convert business inputs into valuable data for use in business transactions, analytics, records management, discovery, and compliance applications.

All business inputs are interpreted to understand the content, and where and why it is needed. Data is extracted, validated, and augmented to create the required information for a business process related to an Accounting Workflow or Case Management type application, to comply with Records Management requirements or fulfil analytics or discovery needs.

In our vertical market sizing and analysis, we cover horizontal use cases e.g., accounting, HR management, as well as vertical specific use cases e.g., bank account opening, mortgage processing and insurance claims processing.

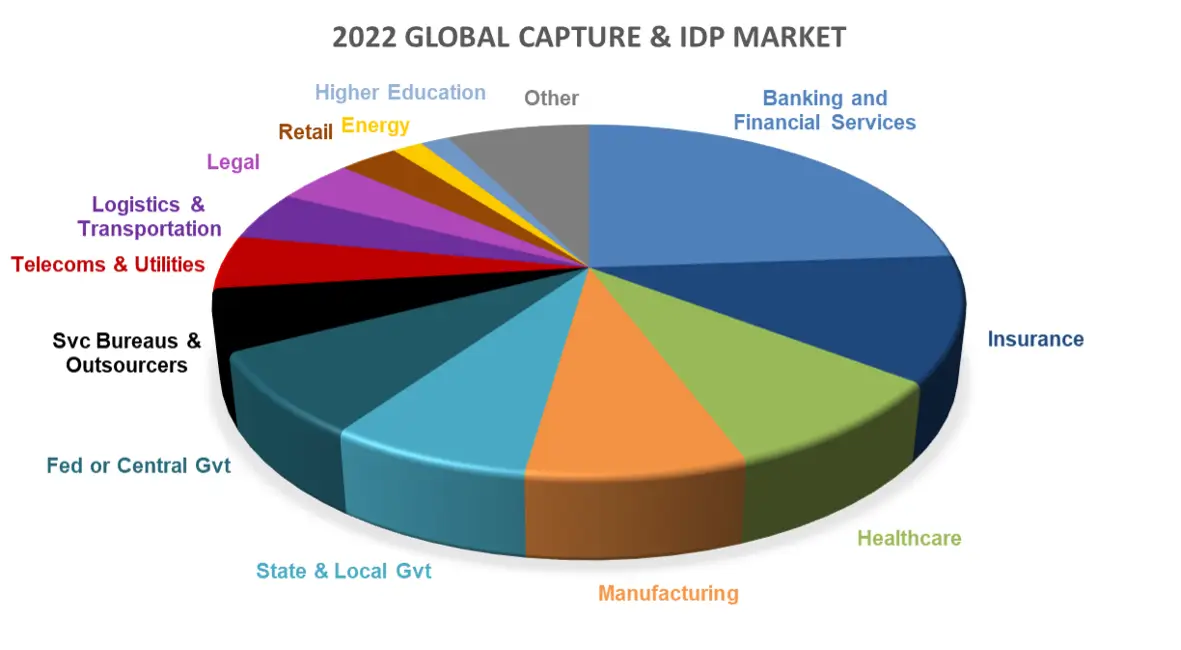

CURRENT VERTICAL MARKET BREAKDOWN

The Finance segment (Banking and Financial Services combined with Insurance) represents the largest industry sector. Sales into the Banking vertical account for over two thirds of the Finance sector and presents by far the largest single largest industry.

The Public Sector, which consists of Federal, State and Local Government (incl. grade schools), is the second largest group of verticals. It continues to lag the private sector despite various government modernisation programs.

The Healthcare segment is the third largest sector based on demand for Capture & IDP Solution sales in 2022. Demand in the sector recovered in 2022 after a difficult time during the pandemic.

The demand in the Manufacturing industry is just slightly smaller and in a similar lower maturity stage

Opportunities in the Finance Sector

Financial institutions adopted Capture and IDP solutions earlier than other verticals, building on their traditional usage of check imaging solutions. Despite their efforts to digitalise processes, which was further accelerated along with the increased use of online banking during the pandemic, their progress is limited by established processes and legacy systems. The newer players in the ecosystem are advantaged by digital first processes that have been designed to provide a superior customer experience.

The Insurance sector has proven to be resilient during the pandemic as well as the phase of instability in the Finance sector earlier in 2023 caused by high interest rates.

Intelligent Capture and IDP use cases in the Banking sector include a variety of case management solutions like account opening, credit card applications, loan, and mortgage applications, as well as wealth management. The Banking sector has been at the forefront of deploying IDP solutions for complex processes, like mortgage applications, the major use case in the United States.

The major Capture & IDP use cases in the Insurance sector also relate to Case Management. Underwriting and claims processing have a key Customer Experience component, in addition to the proven ROI demonstrated by the automation of these processes. We have seen a growing adoption of RPA solutions that include IDP capabilities in these use cases in the past few years. RPA solutions have also functioned as short-term solutions to bridge legacy systems and perform fraud detection queries to advance end-to-end automation.

Demand for Capture & IDP solutions both in the Banking and the Insurance sector has been resilient during the pandemic. Considering the dynamics in both sectors and the advancements in automation solutions involving IDP capabilities, we expect the demand for Capture & IDP solutions in the sectors to grow at double digit rates in our 5-year forecast horizon.

Demand in the Public Sector

In the Public Sector category, we track two sub-segments in the respective geographies: sales to the Central (aka Federal) Government and sales to State and Local Government agencies, where we also include grade schools. It is important to note that in countries where organisations in segments like Healthcare, Education, Transportation or Finance are fully or partially owned by the respective state, the sectors are covered in their respective verticals.

The Public sector is particularly important as governments take a dual role in the digital transformation of a nation. It is an industry segment with similar digital transformation needs to other sectors. But it also often acts as a benchmark for the private sector or invests into broader digitalisation efforts.

Key Capture & IDP use cases include citizen services, often related to applications for a specific service (e.g., for ID, permits, grants, support services etc.). Traditional Capture use cases also include backfile conversion projects for existing archives and records centres. Capture & IDP use cases furthermore cover horizontal applications like HR management.

An inhibitor for the automation of processes in the Public Sector are legacy systems, and other standalone systems and solutions that require a considerable effort to manually transfer data.

We expect demand for Capture & IDP solutions in the Central Government sector to slightly accelerate its growth in the next five years to low double-digit growth. In the State and Local Government sector that was further behind in their digital transformation, the pandemic caused the acceleration of digitisation efforts in 2020, but most of them can be described as emergency measures. We expect high single digit growth in demand for Capture & IDP solutions by State and Local Government agencies in the next few years.

Changing priorities of Healthcare providers

In our vertical analysis of the opportunity in the Healthcare sector, we focus on Healthcare providers; Healthcare payers are included in our assessment of the Insurance vertical.

The Healthcare sector was hit particularly hard by the COVID-19 pandemic, the impact has transformed and will continue to transform the sector substantially.

Capture and IDP solutions come into play both in primary healthcare use cases i.e., in patient facing processes as well as in secondary use cases i.e., in administrative processes and analytical efforts – which both free up staff and increase directly or indirectly the patient care and experience. Having real-time updates in medical records available to medical staff provides essential value in preparation for and during patient treatment.

While there is significant opportunity for IDP solutions augmented by LLMs and Generative AI technology in patient facing processes like patient onboarding, patient inquiries, and follow-up, we expect the short-term investment focus of healthcare providers to be on the automation and integration of clinical systems as well as research and predictive analytics. Administrative processes, like the documentation and communication with payers, are expected to take a secondary priority in the next few years. As a result, we predict single digit growth in the next 5 years.

Transformation of the Manufacturing industry

In our analysis the Manufacturing sector comprises a wide range of organisations, ranging from fast-moving consumer goods (FMCG) to high-end technology manufacturers. Some manufacturing sectors, like automotive or consumer electronics are located only in specific countries, which impacts the geographic mix of opportunities for the Capture & IDP market.

The most prominent Capture use case in the Manufacturing sector is invoice processing, which continues to broaden acceptance in the mid-size and small enterprise segments. More advanced manufacturers continue to expand in broader process automation of their accounting processes i.e., P2P and OTC process enhancements. In our forecast period and continuing in the next part of the decade national e-invoicing mandates will impact the level and type of demand for invoice processing. On the other hand, the interest in order processing, and adjacent processes like supplier management will see growing interest as part of broader digitisation efforts.

The vision of Industry 5.0 reflects the growing need to add social and environmental requirements as well as resilience to technological innovation. This broader scope also opens a larger opportunity for the integration of IDP use cases, particularly those associated with customer experience and demand analytics and forecasting. These dynamics in demand coupled with growing capabilities of AI based solutions and end-to-end automation platforms will drive a double digit CAGR for the next 5 years.

New Opportunities for Managed Service Providers and Outsourcers

This segment includes Service Providers who offer outsourcing services for process steps, entire processes or even business functions for a private or public organisation. These outsourcing services must include the processing of unstructured or semi-structured business inputs.

From a Capture and IDP perspective, the requirements align with the sophistication of the managed services. They range from Basic Capture, i.e., digitisation of paper documents or capture of digital documents into a repository, to the ingestion of business inputs into a transactional process with various levels of automation and integration with enterprise systems and workflow tools.

The mix of outsourcing providers is shifting to more sophisticated service providers who invest in IDP technologies. As advanced AI technologies continue to offer attractive returns, but business and public organisations lack the knowledge and expertise to deploy them and are concerned about data security, they will increasingly turn to GBS providers. Traditional Service providers focused on Basic Capture will increasingly struggle and may face insolvency or become an acquisition target if their customer base or assets are attractive for other vendors. We have therefore increased our growth projections for the segment globally to a solid double-digit rate for the forecast period.

The dual role of Telecommunication & Utilities providers

In this analysis we include the Telecommunication and Utilities industries, which we cover as a combined sector from a sizing and forecasting perspective. The two sectors have several things in common, starting with the fact that they both include vital infrastructure elements and their respective ecosystems. The Telecoms sector includes providers of phone and data services, which often also own their network infrastructures. In the Utilities sector our assessment includes providers of water and electricity, based on fossil fuels as well as renewable energy sources.

The major Capture & IDP use cases in both industries are customer onboarding, management and offboarding, which are becoming even more important considering the increasing customer experience expectations. Capture and IDP solutions will play an increasingly important role in automating transactional processes in response to increasing expectations for fast and efficient handling of requests.

The market dynamics in the Telecoms and Utilities sectors have led to significant growth during the pandemic and over proportional demand in 2022 in the Telecommunication industry. We predict a growth in global demand with double digit growth rates for the combined sector.

Opportunities in Logistics & Transportation

This industry sector in our analysis includes the Shipping and Logistics industry, which is a critical component of the supply chain ecosystem. The second element covers the Transportation ecosystem, which, depending on the geography, may have a strong tourism component.

Key Capture & IDP use cases in both sectors are the automation of accounting processing including purchase order initiation, order handling and supplier onboarding and management as well as invoice processing. Both sectors are labour intensive, hence employee onboarding and HR management are important use cases as well. Additional use cases in the Logistics sector are shipment scheduling and documentation, inventory management and supply chain management.

There is growing potential for Capture & IDP solutions in the combined sectors, and we expect the deployment of digitalisation solutions for administrative processes to gradually accelerate in the next 5 years.

Transformation of the Legal Sector

In our market assessment the legal sector includes two types of organisations and users: law firms as well as in-house legal departments.

Traditional Capture & IDP use cases involve the digitisation of legal documents and document management and increasingly the automation of administrative processes like contract management, HR management, the tracking and recording of billable time as well as the billing and payment collection. The increasing interest of law firms in deploying comprehensive digital strategies for their organisations expands into discovery and the development of legal documentation.

Advanced AI tools are showing impressive results in select use cases. We increased our expectations compared to last year’s forecast to reflect the opportunities emerged based on the latest AI developments.

Infosource Software Division

Infosource is the leading analyst firm for Intelligent Capture and IDP Software market analysis and consulting with more than 20 years of experience in this field.

This blog post is an extract of the 2022–23 Global Capture & IDP Software Vertical Market Report, one of the elements of the Infosource Capture Software analyst services. It provides an in-depth assessment of the Vertical Market size, forecast, use cases and industry dynamics by vertical.

Please contact Petra Beck at [email protected] or +49-1704567908 to discuss how the Infosource Capture & IDP Services can help you grow your business.