KEY TAKEAWAYS

- Market Scope and Methodology: This assessment of vertical opportunities for IDP solutions is a key pillar of Infosource’s analyst services. The quantitative analysis of IDP investments by industry sector is based on vendor inputs and forecasts future demand based on industry dynamics in key countries.

- Digital Maturity and Demand Correlation: The analysis shows a strong correlation between expected demand and the digital maturity of each vertical, influenced by infrastructure sophistication, technology expertise, and investment access.

- Role of AI and GenAI: AI, particularly GenAI, plays a crucial role in the IDP industry, enhancing solutions by improving data classification, extraction, and process automation. The most advanced sectors in digital transformation, such as Banking and Insurance, are leading in AI adoption.

- Sector-Specific Opportunities: The report identifies significant opportunities in sectors with advanced digital transformation, such as Banking, Insurance, Healthcare, and Manufacturing. Sectors with lower digital maturity, such as Legal and Education, show varied deployment speeds.

- Geographic Characteristics: The demand for IDP solutions varies by region, influenced by infrastructure availability, local technology conditions, investment opportunities, and compliance requirements.

VERTICAL MARKET FRAMEWORK

Infosource defines the Intelligent Document Processing (IDP) Software market as solutions and services used to ingest and process business inputs which involve semi-structured and unstructured documents and other input types. These solutions are designed to acquire, classify, validate, and convert business inputs into valuable data for use in business transactions, analytics, records management, discovery, and compliance applications. All business inputs are interpreted to understand the content, and where and why it is needed. Data is extracted, validated, and augmented to create the required information for a business process related to an accounting workflow or case management type application, to comply with Records Management requirements or fulfil analytics or discovery needs.

The market has evolved from “Capture”, which itself has shifted from document capture to omni-channel capture and from “Basic Capture” to “Advanced Capture” and “Intelligent Capture”. Vendors focused on the ingestion of unstructured business inputs expanded their solutions to cover additional process steps involved in information-intensive business processes. They were joined by vendors who specialise in the automation of business processes and added capabilities to ingest unstructured business input. The expansion from information capture and extraction to information processing is becoming increasingly important as it significantly expands the value of Capture and IDP solutions in the context of end-to-end process automation.

The anticipated evolution of Advanced AI technologies, their inclusion in IDP and automation solutions, and their deployment in the respective verticals and use cases play a key role in our forecasts. In our vertical market sizing and analysis, we cover horizontal use cases such as accounting and HR management, as well as vertical-specific use cases such as bank account opening, mortgage processing, and insurance claims processing.

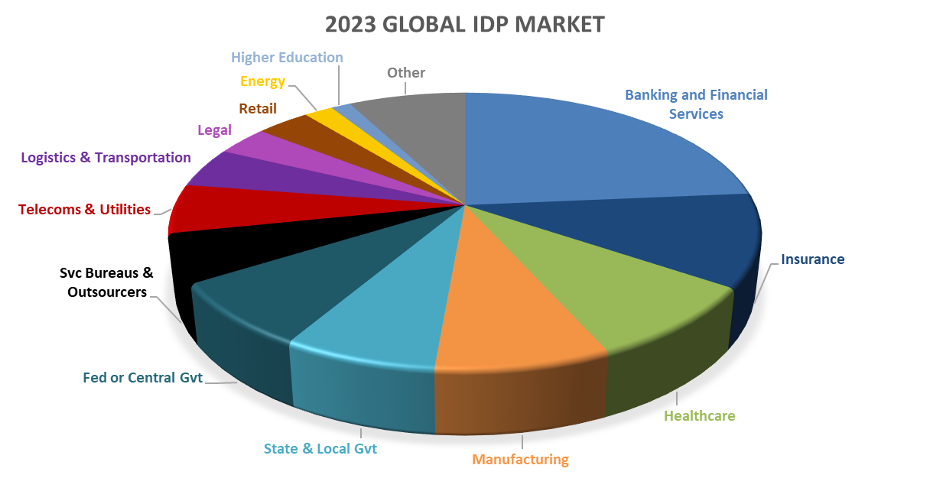

CURRENT VERTICAL MARKET BREAKDOWN

Our assessment of end customer investments based on vendor inputs through 2023 highlights the diverse deployment of IDP solutions across private industry sectors and the Public Sector. IDP solutions support common use cases like accounting and HR management, with varying significance across verticals; for instance, invoice processing is prominent in Manufacturing, while HR management is crucial in Retail.

Vertical-specific use cases, particularly onboarding processes, also drive demand, with complexities differing significantly between sectors such as account opening, patient onboarding, and insurance underwriting. Additionally, some sectors actively contribute to IDP development, with governments playing a key role through funding and directives, and infrastructure providers like Telecom and Energy companies enabling digital transformation. The Higher Education sector, supported by consultants and in-house training, is vital in reducing knowledge gaps and showcasing digital transformation examples.

We expect the strongest growth in verticals with advanced digital transformation and automation of information-intensive business processes. The Banking and Financial Services sector tops the opportunity list, followed by the Insurance sector. Sectors with medium automation levels, such as Healthcare and Manufacturing, are expected to quickly overcome inhibitors and leverage new automation opportunities. For verticals with low digital maturity, such as Legal and Education, deployment speed will depend on organisational culture, expertise, and demonstrated ROIs in critical use cases. Notably, the Public Sector exhibits significant variability in digital maturity, with some agencies highly digitised and automated, while others still rely on manual, paper-based processes.

Significant Opportunities in the Finance Sector

The Banking and Financial Services sector remains the strongest in IDP adoption, driven by regulatory compliance, competitive pressure, and the need for operational efficiencies. The automation of transactions like account opening and mortgage processing leads to improved operational efficiencies and increased customer satisfaction. GenAI technologies are expected to enhance customer service by providing personalised banking services, real-time analytics, and automated AML and KYC checks. Advanced IDP solutions can streamline regulatory assessment steps like KYC and AML; in addition, GenAI-based solutions allow for real-time risk assessment during transactional processes.

The Insurance sector is undergoing a transformative shift, with a focus on personalised offers and operational efficiencies. IDP solutions with robust onboarding capabilities are essential for acquiring new customers, upgrading policies, and driving subscriptions in the insurance sector. Generative AI enhances the efficiency and accuracy of document and multi-modal input ingestion, supporting personalised policy offerings and communication by analysing customer data. Additionally, GenAI technologies improve the processing of claims, enhancing operational efficiencies, customer satisfaction, and fraud detection. IDP solutions play a crucial role in building knowledge bases for analytics, compliance, and customer communication, supporting both self-service tools and human agents with updated information.

Multi-dimensional demand in the Public Sector

The Public Sector is particularly important as governments not only represent important IDP use cases, but they also guide the digital transformation and technology adoption in a country through initiating and funding technology development. This also extends into the development and reinforcement of laws and regulations. The current digital maturity varies significantly between agency types and geographies. IDP solutions are widely deployed across central, state, and local government levels, with key federal use cases including tax processing, passport applications, and immigration services. GenAI technologies enhance these solutions by supporting analytics for trend documentation, improving transactional processes like citizen service requests, and aiding in fraud detection. Local Public Sector use cases focus on citizen services such as social security and unemployment. Given the current digital maturity and specific demands, the Federal Government sector is expected to grow faster compared to the State and Local Government sector.

Healthcare providers address growing challenges with AI based solutions

The Healthcare sector faces increased demand for services and a shortage of staff. IDP solutions in the Healthcare sector have significant potential to enhance administrative and clinical processes. Key use cases include patient onboarding, procedure planning, and real-time digitisation and analysis of medical documentation, which support GenAI-based analytics for treatment and recovery suggestions. GenAI also aids in personalising treatments and post-surgery recovery guidance. Additionally, IDP solutions improve administrative efficiency, reducing clinician burnout and lowering costs through better management of patient records, reimbursement communications, and HR processes. GenAI-based IDP solutions will create strong interest in the mid-term.

Major opportunities in the Manufacturing industry beyond invoice processing

The Manufacturing sector is evolving towards Industry 5.0, emphasising human-machine collaboration and sustainability. In the Manufacturing sector, IDP solutions are primarily used for accounting, particularly invoice processing, which is crucial for both large and small organisations. Large manufacturers aim to fully automate P2P and OTC processes, integrating invoice processing with goods receipt and warehousing. E-invoicing mandates will significantly impact this sector, with vendors offering consulting and support for compliance gaining an advantage. Other administrative uses include supplier and employee onboarding, management, and compliance reporting. IDP solutions also support core processes like customer support and engineering.

Managed Service Providers and Outsourcers at a crossroad

Service Providers who are focused on traditional Capture services will face even stronger price pressure in a rapidly declining market subsegment. On the other hand, outsourcers who offer more comprehensive managed services covering entire document-centric business transactions will see accelerated growth in demand. GenAI technologies present major opportunities: reducing manual process steps, enabling new services like analytics and customer service, and increasing strategic importance by becoming centres of excellence and consultants for automation solutions. These opportunities will help outsourcers advance their offerings and portfolios, widening the gap between advanced service providers with integrated IDP services and those offering traditional digitalisation services.

Secondary Verticals

Telecommunication, Utilities, Energy, Logistics, Transportation, Legal, Retail, and Higher Education sectors, currently at an earlier stage of maturity in their digital transformation, also present significant opportunities for IDP solutions. Common drivers are pressure to improve operational efficiencies and provide enhanced customer service.

Infosource Software Division

Infosource is the leading analyst firm for Intelligent Document Processing Software market analysis and consulting with more than 20 years of experience in this field. This blog post is an extract of the 2023–24 Global IDP Software Vertical Market Report, one of the elements of the Infosource Software analyst services. It provides an in-depth assessment of the Vertical Market size, forecast, use cases, and industry dynamics by vertical.

Please contact Petra Beck at [email protected] or +49-1704567908 to discuss how the Infosource IDP analyst services can help you grow your business.