Infosource’s 2025 Global Vertical IDP Market Analysis reveals how Generative AI and agentic automation are reshaping document-centric workflows across every industry.

Key Takeaways

- Market Scope and Methodology: This assessment of vertical opportunities for IDP solutions remains a cornerstone of Infosource’s analyst services. It combines quantitative analysis of IDP investments by industry sector with forecasts based on technology adoption trends, regulatory dynamics, and regional market conditions.

- Digital Maturity and Demand Correlation: The correlation between digital maturity and IDP demand will become even more pronounced in future. Verticals with advanced infrastructure, strong technology expertise, and investment capacity are at the forefront of embracing Generative AI (GenAI) technology and agentic automation – accelerating both digital maturity and automation adoption.

- Role of GenAI and Agentic Automation: GenAI has advanced beyond the hype phase and is starting to deliver measurable ROI in production workflows. All key IDP use cases – from onboarding and claims handling to compliance reporting – can be enhanced with GenAI for faster, smarter outcomes. Agentic automation represents the next frontier, enabling autonomous orchestration of multi-step, information-intensive processes. Ethical deployment and enterprise-grade guardrails are critical to realizing these benefits responsibly.

- Sector-Specific Opportunities: Banking and Insurance remain the most mature adopters, scaling GenAI for compliance-heavy workflows. Healthcare and Manufacturing show strong momentum, while Retail stands out for strong future automation opportunities involving omnichannel input. Public Sector has a key opportunity to enhance its digital maturity through GenAI and agentic automation but is constrained by budget and skills. Legal and Higher Education continue to modernize gradually, constrained by budget and governance hurdles.

- Geographic Characteristics: North America leads in compliance-driven innovation and scaled deployments. APAC accelerates with digital banking and healthcare modernization. EMEA growth is anchored in regulatory mandates and sustainability initiatives, while Latin America emerges as opportunity despite macroeconomic volatility.

Market Framework AND THE ROLE OF GENAI AND AGENTIC AUTOMATION

Infosource defines the Intelligent Document Processing (IDP) Software market as solutions designed to ingest, classify, validate, and convert semi-structured and unstructured business inputs into structured data for transactions, analytics, compliance, and records management. The market has evolved from basic capture to omni-channel input management and now integrates advanced AI technologies for end-to-end process automation.

GenAI has transformed IDP by enabling dynamic input processing, reducing training requirements, and accelerating deployment. Beyond extraction and validation, GenAI adds value through automated data augmentation, risk assessment, and personalized communication.

Agentic automation represents the next stage of evolution. Unlike task-level automation, agentic AI introduces autonomous orchestration of multi-step workflows. These AI agents adapt dynamically to context, execute decisions, and coordinate downstream processes without manual intervention. In the IDP context, this means moving beyond document processing to fully automated workflows such as onboarding, claims handling, and compliance reporting. When deployed responsibly – with enterprise-grade guardrails for security, transparency, and ethics – agentic automation can deliver transformative efficiency and resilience for information-intensive processes.

VERTICAL READINESS AND GROWTH POTENTIAL

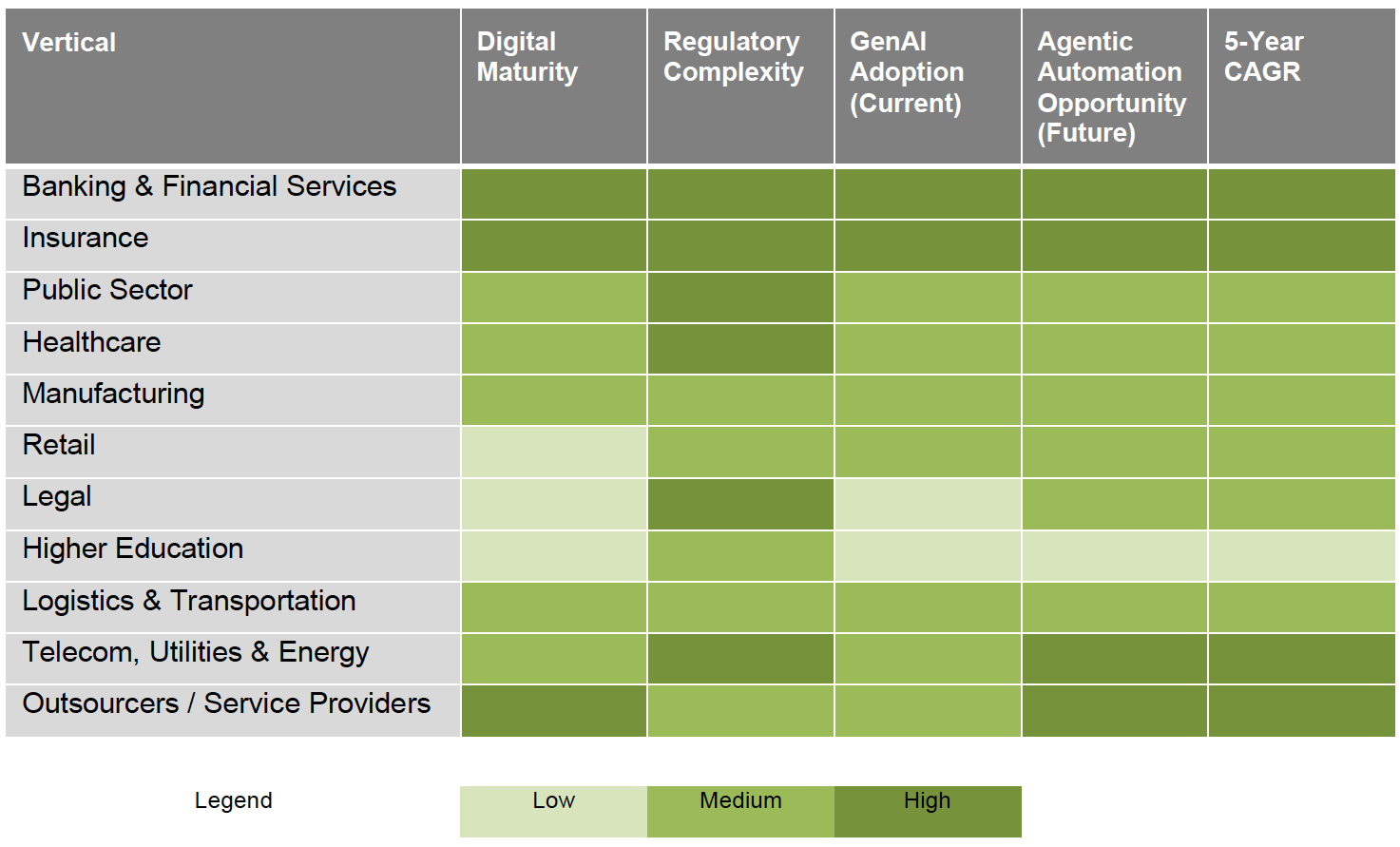

The heat map below illustrates the diversity of conditions shaping IDP adoption across industries. It benchmarks verticals against five dimensions:

- Digital Maturity – Degree of digital transformation achieved

- Regulatory Complexity – Compliance requirements influencing adoption speed

- GenAI Adoption (Current) – Extent of GenAI deployment in IDP workflows

- Agentic Automation Opportunity (Future) – Potential for multi-step process automation

- Growth Outlook – Relative growth expectations based on market dynamics

Key take-aways:

- Banking & Insurance remain the clear leaders across all dimensions, combining high digital maturity, strong GenAI adoption, and robust growth outlook despite regulatory complexity.

- Public Sector shows moderate maturity but significant GenAI and agentic automation potential, though budget and skill constraints remain key hurdles, in particular in State & Local government.

- Healthcare, Manufacturing and Telecom & Utilities occupy the mid-tier, with accelerating GenAI adoption and solid growth prospects.

- Retail stands out for low current maturity but strong future automation opportunities, driven by supply chain and vendor document processes.

- Legal and Higher Education remain at the lower end of maturity and adoption, with moderate growth forecasts. Legal offers niche high-value opportunities in contract analytics and compliance.

- Outsourcers exhibit mixed maturity: traditional BPOs face the lowest growth outlook, while advanced digital outsourcers emerge as strong enablers and early adopters of agentic workflows.

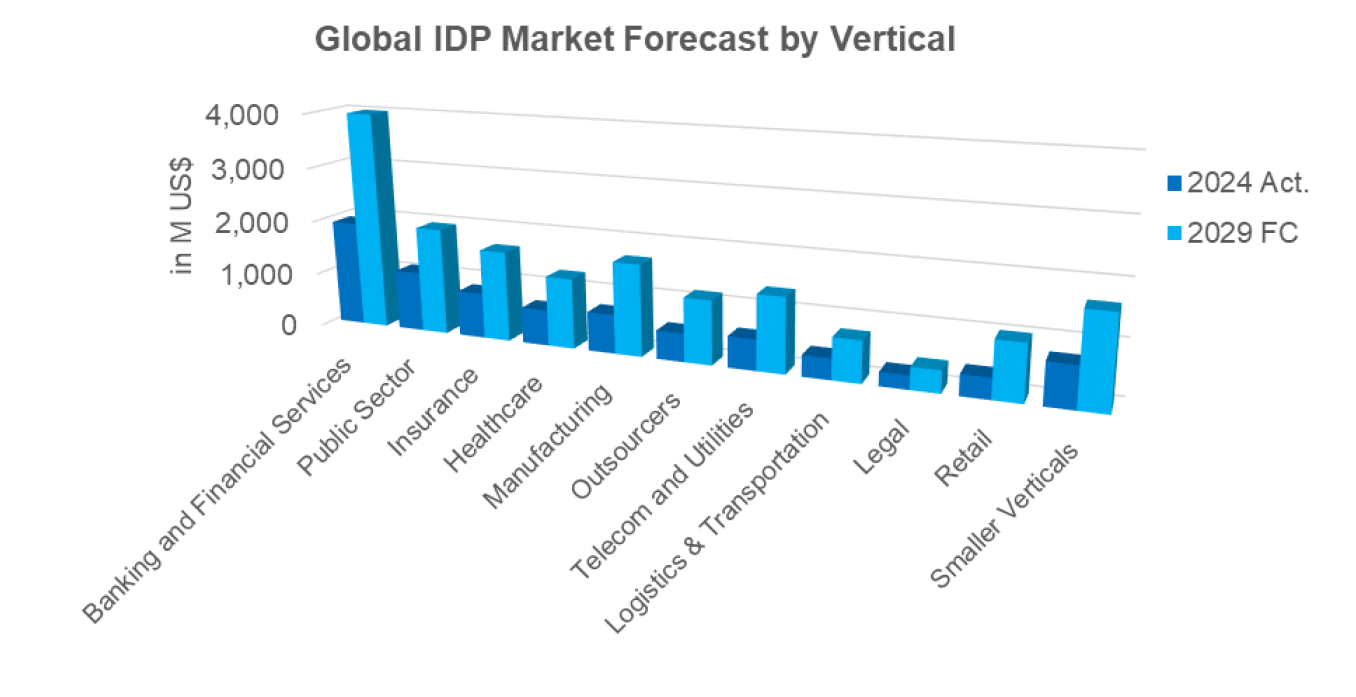

In quantitative terms the consolidated regional and subregional growth projections result in the following global growth expectations for the vertical IDP segments.

IN-DEPTH VERTICAL ANALYSIS

Banking & Financial Services: Scaling GenAI and Preparing for Agentic Automation

The Banking and Financial Services sector continues to lead in IDP adoption, driven by regulatory compliance, fraud prevention, and the race to deliver seamless customer experiences. Institutions are moving beyond basic digitization to orchestrate end-to-end workflows for onboarding, lending, and regulatory reporting. Generative AI is now embedded in production, enabling dynamic document validation, multilingual communication, and risk-tiering summaries. Agentic automation is emerging as the next step, coordinating complex KYC, and lending processes autonomously while maintaining auditability – critical in an environment shaped by evolving regulations and heightened scrutiny.

Insurance: Transforming Claims and Underwriting with AI

Insurance is undergoing a profound transformation as carriers seek to counter rising claims inflation and fraud risk while improving customer engagement. IDP solutions have become essential for accelerating claims processing, underwriting, and compliance reporting. GenAI enhances efficiency by interpreting multimodal inputs, detecting anomalies, and personalizing policy communications. Early agentic automation pilots are showing promise in orchestrating entire claims lifecycles, reducing manual intervention, and improving audit readiness. These advances position Insurance as one of the most mature verticals for AI-driven automation.

Public Sector: Unlocking Efficiency and Transparency with AI

Public Sector organizations are under pressure to modernize services, reduce backlogs, and meet rising citizen expectations for digital-first experiences. IDP solutions are increasingly deployed for benefits applications, permissions, and procurement workflows, with GenAI enhancing document validation, multilingual communication, and automated redaction. Agentic automation represents a significant opportunity, enabling autonomous orchestration of eligibility checks, procurement-to-pay cycles, and case administration across departments. While progress remains uneven, digitally advanced governments are setting the pace for transformation.

Healthcare: Addressing Operational Pressures Through Intelligent Automation

Healthcare providers face mounting operational pressures from staff shortages, administrative complexity, and rising patient expectations. IDP solutions combined with GenAI are alleviating these challenges by automating patient onboarding, and clinical documentation. GenAI improves accuracy and speed in extracting data from diverse sources, drafting summaries, and supporting multilingual communication. Agentic automation offers even greater potential, orchestrating multi-step workflows such as prior authorization, care coordination, and compliance reporting—helping providers deliver better care while reducing administrative burden.

Manufacturing: Moving Beyond Invoice Processing to End-to-End Automation

Manufacturing is accelerating toward Industry 5.0, where resilience, sustainability, and compliance drive automation priorities. While invoice processing remains a core use case, IDP solutions are expanding into supplier onboarding, ESG reporting, and quality documentation. GenAI enables multilingual interpretation and anomaly detection across global supply chains, while agentic automation promises end-to-end orchestration of P2P and OTC processes. These capabilities are critical as manufacturers strive for operational agility.

Managed Service Providers and Outsourcers at a crossroad

Service Providers who are focused on traditional Capture services will face even stronger price pressure in a rapidly declining market subsegment. On the other hand, outsourcers who offer more comprehensive managed services covering entire document-centric business transactions will see accelerated growth in demand. GenAI technologies present major opportunities: reducing manual process steps, enabling new services like analytics and customer service, and increasing strategic importance by becoming centres of excellence and consultants for automation solutions. These opportunities will help outsourcers advance their offerings and portfolios, widening the gap between advanced service providers with integrated IDP services and those offering traditional digitalisation services.

Secondary Verticals: Emerging Opportunities Across Diverse Sectors

Beyond the core industries driving IDP adoption, several secondary verticals are advancing their automation agendas. Retail is accelerating rapidly, fuelled by omnichannel commerce and the need for real-time supply chain visibility. Telecommunications, Utilities, and Energy providers are leveraging IDP for customer onboarding, billing accuracy, and compliance reporting, while Logistics and Transportation focus on automating shipment documentation and cross-border compliance. Legal and Higher Education remain early-stage adopters, piloting GenAI for document review, administrative workflows, and multilingual processing. While these sectors vary widely in maturity, they share common drivers: operational efficiency, compliance readiness, and the growing imperative to deliver digital-first experiences.

Infosource Software Division

Infosource is the leading analyst firm for Intelligent Document Processing Software market analysis and consulting with decades of experience in this field. This blog post is an extract of the 2024–25 Global IDP Software Vertical Market Report, one of the elements of the Infosource Software analyst services. It provides an in-depth assessment of the Vertical Market size, forecast, use cases, and industry dynamics by vertical.

For more information or to request a copy, contact [email protected].