An overview of Infosource research into this market, we begin with a few quick takeaways before going into more detail.

Key Takeaways

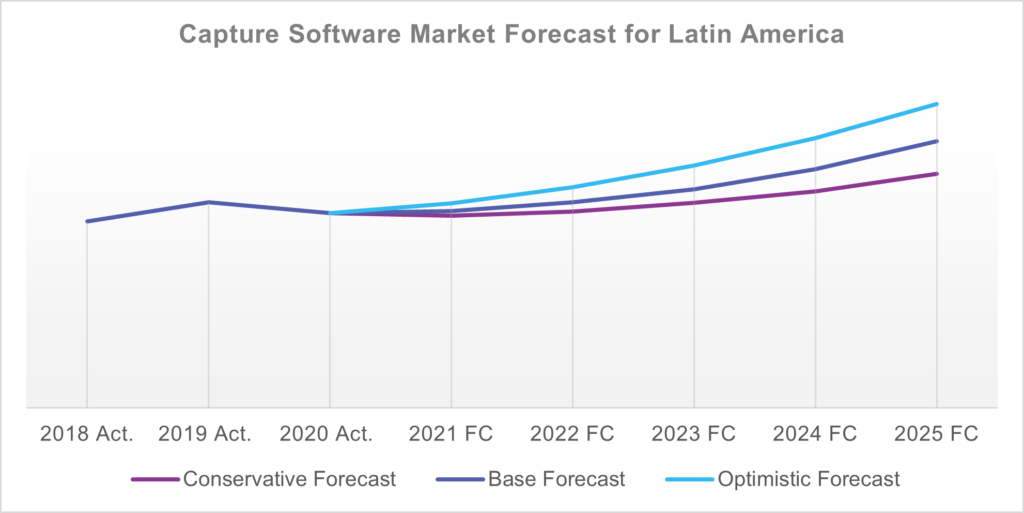

- The market for Information Capture in Latin America is still at an early level of maturity. Prior to the pandemic, the regional market revenue for Capture Software had been growing at a double-digit pace. The pandemic has impacted the Capture market in Latin America more severely than other regions. Infosource projects a slow recovery of market demand for Information Capture solutions followed by strong growth.

- The Capture related RPA market in Latin America had been growing exponentially before the pandemic and more than doubled its size in the region. Infosource expects the demand for business automation to further accelerate and create a demand for Case Management solutions. The Intelligent Document Processing (IDP) segment within the RPA market, has started to converge with the traditional Capture market as it targets similar business applications, i.e., use cases involving document centric business transactions.

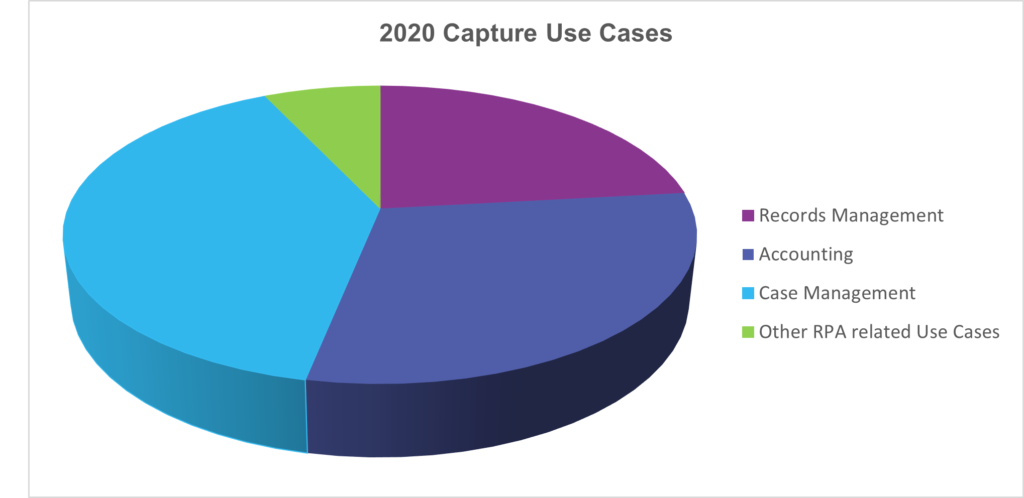

- Infosource expects Case Management use cases to grow steadily in the years to come as organizations seek to automate their business transactions. Accounting will continue to offer a key opportunity for Capture solutions and increasingly RPA solutions.

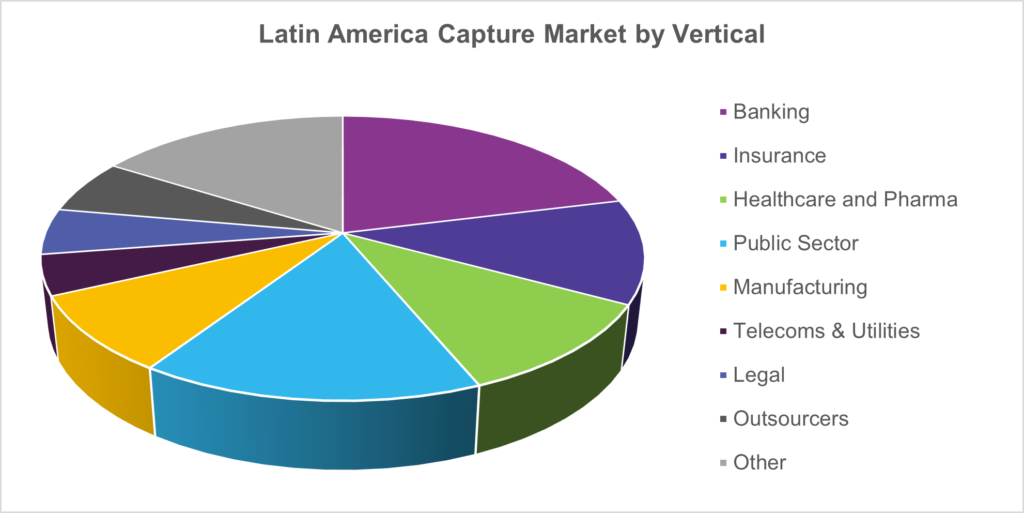

- The largest verticals for Capture software in Latin America are the Finance and Public sector followed by Healthcare and Manufacturing.

Capture Market Framework

Capture Software includes solutions and services used to process business inputs. Capture Software understands and extracts meaningful, accurate, and usable information. It acquires, classifies, and converts unstructured and semi-structured information into enhanced usable data for use in business transactions, analytics, records management, discovery, and compliance applications.

Historically business inputs have been primarily received as paper documents which needed to be digitized and converted into usable, validated data, ideally with minimal human involvement. Business inputs have increasingly shifted from paper inputs to a variety of digital sources arriving via a broad range of communication channels including email, fax, smart devices, and social media. Inputs can include not only documents and other text-based sources, but also voice, photos, videos, and IoT channels. All inputs are interpreted to understand the content, and where and why it is needed. Data is extracted, validated, and augmented to create the required information for a business process to drive a transaction, comply with records management requirements or facilitate customer communications.

Information Capture solutions can be solutions and services focused on the ingestion of business inputs, they can also be an element of a Content Management or Business Process solution.

The underlying technologies may include traditional recognition and extraction technologies, AI-based recognition and NLP technologies and RPA and other workflow automation technologies, often including machine learning technologies.

Status and Projections for the Information Capture Market in Latin America

The Information Capture market in Latin America is still at an early stage regarding its maturity. Cost involved in manual business interactions are not as high as in other geographies driven by salary levels, hence the pressure to reduce manual interactions was not as strong. In addition, the infrastructure required for digital transformation continues to be limited in many countries, which causes an additional hurdle for the digitization and automation of business processes.

Influencing factors for the market recovery are COVID-19 infection levels, coupled with the progress on vaccination, the economic situation and the infrastructure and digitalization level in the major countries. Infosource projects a slow recovery of market demand for Information Capture solutions, likely returning to the 2019 level in 2022.

The Robotic Process Automation (RPA) market, which we consider largely adjacent to the Capture Software market, is also at an early stage of maturity in Latin America. The Intelligent Document Processing (IDP) segment within the RPA market, has started to converge with the traditional Capture market as it targets similar business applications, in particular those related to automating document centric business transactions. The RPA market in Latin America has been growing exponentially in the past three years continuing its strong growth during the pandemic.

The strong demand for RPA solutions is expected to continue, but we expect capture-related RPA offers to converge. These solutions will compete with Intelligent Capture solutions for the same use cases and will likely be fulfilled by Capture vendors through their expanded portfolio or RPA vendors providing IDP-type offers or partnerships with Capture vendors.

Capture and RPA Use Cases

Records Management as the primary reason for Capture, which was the major use case a decade ago, will continue to decline; however, the smaller elements of this use case segment, Analytics and Discovery, will present growing opportunities.

Accounting has been and will continue to offer a key opportunity for Capture solutions and, increasingly, RPA solutions.

Infosource expects Case Management solutions to grow steadily in the years to come as organizations seek to automate their business transactions, e.g., customer / patient / employee onboarding and claims / mortgage applications.

In addition to the IDP solutions, which overall with the traditional Capture use cases, RPA use cases include customer support applications, reporting focused use cases. e.g., journal entries and other applications that involve the automated extraction of data from websites or legacy systems which replace manual data entry.

Impact of the COVID-19 Pandemic on the Market Demand in Latin America

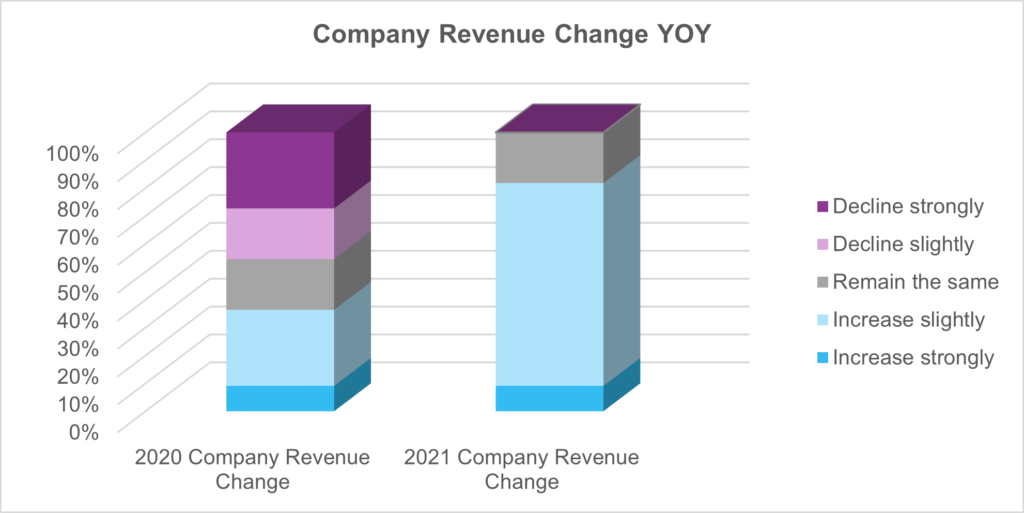

Lockdown measures implemented by most governments caused a slow-down of the business activities and a delay or cancelation of many Capture projects to be postponed or delayed. In a survey conducted in June 2020 with resellers and vendors of Capture solutions part of the respondents reported a slow-down in their company revenues. For 2021 most expect at least a slight increase, which confirms the positive business climate related to the expected recovery of market demand.

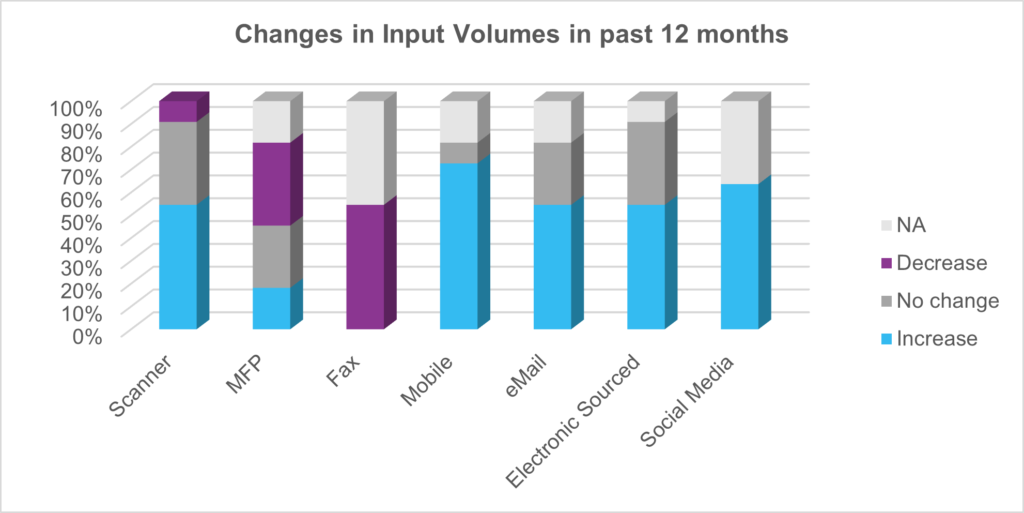

The input sources for Information Capture also changed considerably in the past 12 months. Mobile input volumes increased for most respondents supporting this input channel during the pandemic. Half of the respondents reported an increase in digital input volumes, including email, electronic-sourced inputs, and social media.

Volumes captured with scanners increased according to half of the respondents, a few reported a decline. Volumes captured with MFPs declined based on the reports from survey respondents, only a few saw an increase. Fax inputs declined based on respondents covering this input channel.

Vertical Markets

Traditionally the Finance and Public sector have been the major Capture markets in Latin America. They continue to reflect the largest vertical demand followed by Healthcare and Manufacturing.

Conclusion

Infosource has recently published a special report covering the State of the Information Capture market in Latin America. This report is part of the annual subscription of our Capture Software Services, it is also available for purchase. Please contact our sales team ([email protected]) if you are interested in learning more about this publication or other Infosource services.