KEY TAKEAWAYS

- Globally end customer organisations invested close to 7 Billion US$ into IDP solutions in 2023. The demand for IDP solutions grew at solid double digit rate compared to the previous year.

- The demand for the automation of business processes continues to increase, fueled by the shortage of skilled staff. 2023 showed a particularly strong growth of IDP solutions offered by vendors who specialise in enterprise automation solutions.

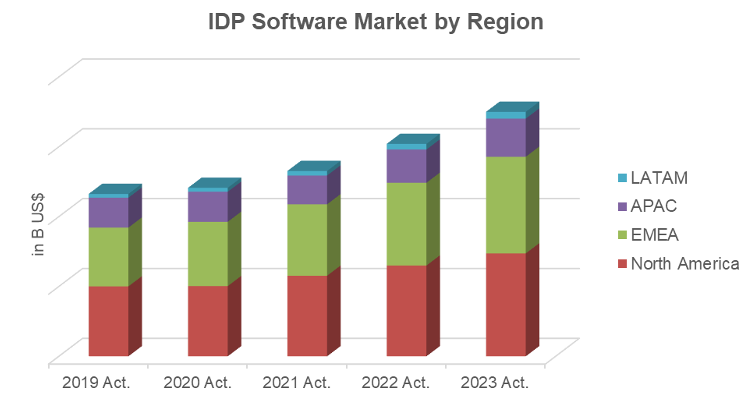

- In North America the demand for IDP solutions accelerated in 2023. The demand in EMEA increased in 2023 at a strong double-digit growth rate boosted by strong demand in the Eastern European and Middle Eastern subregions. The demand in Asia continued at a high level in 2023, similar to 2022 which marked a strong recovery after the pandemic. In Latin America the demand for IDP solutions grew strongly, however, remaining at a small base.

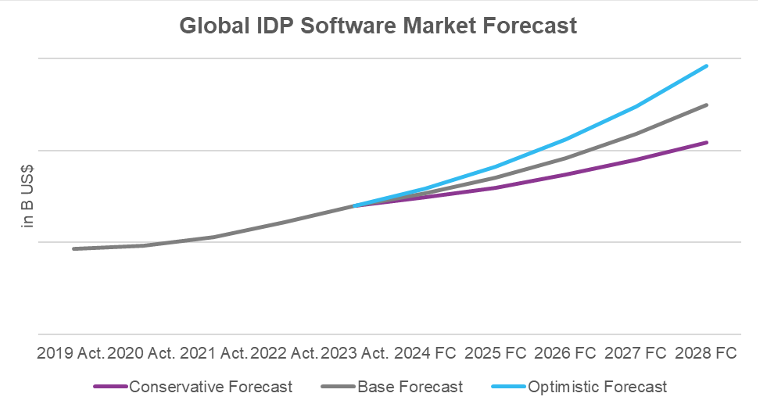

- In our forecast period from 2024 to 2028 we predict a double digit CAGR, a slight increase compared to the past four years, which were heavily influenced by the pandemic.

- In the next two years we expect investments to be slightly delayed while end customers close their AI skill gaps and refine their investment plans. In the second part of the forecast horizon and beyond we predict a boost of demand as organizations step up their investments to take advantage of IDP solutions that have been advanced to leverage language models, and significant progress has been made on ethical concerns related to GenAI.

- In our assessment of use cases, we expect the demand for these solutions to grow over proportionally in the next 5 years as GenAI technologies enable advanced automation capabilities and integrated customer communication features. We also forecast an ongoing strong demand for IDP solutions to automate Accounting processes while e-invoicing mandates expand, broadening into P2P and OTC automation.

CAPTURE & IDP MARKET FRAMEWORK

Infosource defines the IDP market as software and services that are used to ingest and process business inputs which involve unstructured documents and other input types. These solutions are designed to acquire, classify, validate, and convert business inputs into valuable data for use in business transactions, analytics, records management, discovery, and compliance applications.

Business inputs have increasingly shifted from paper to a variety of digital sources arriving via a broad range of communication channels including email, fax, smart devices, and social media. Inputs can include not only documents and other text-based sources, but also voice, photos, videos, and IoT channels.

The software and services covered in this IDP market assessment range from tools and SDKs (Software Development Kits) to point solutions for data extraction from documents, and more comprehensive solutions for records management and business transactions. These solutions are increasingly utilized in end-to-end automation of business processes. The deployment of IDP solutions ranges from on-prem software that runs on a laptop or on-site server to cloud-native platforms that are available as hosted services.

IDP MARKET SIZE BY GEOGRAPHY

The expansion of the global IDP market accelerated in 2023 to 7B US$ measured in end customer investments in tools and solutions provided by IDP software vendors. This growth rate exceeds the pre-pandemic growth rates in the market from a global perspective.

Demand in North America accelerated in 2023, returning close to the post-pandemic growth rate of 2021.The development of the European market value was positively influenced by a recovery of the foreign exchange (fx) rate for the Euro as well as the British Pound even exceeding the strong pre-pandemic growth.

The demand for IDP solutions in Asia remained high, just slightly lower compared to the strong recovery level of 2022. The growth rate in Latin America was the highest compared to the other regions in 2023; however, this geography is still in a rather early stage in digital transformation in 2023.

CAPTURE USE CASES

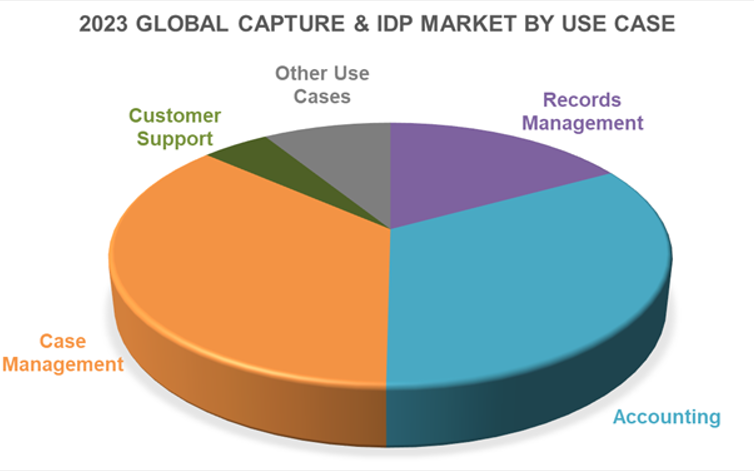

Infosource analyses the use cases related to the primary reason for deploying an IDP or broader automation solution, keeping in mind that there continue to be secondary use cases of high importance, like Records Management for compliance reasons.

In 2023 Case Management use cases grew strongly further expanding this largest use case group. The growing demand for this use case group correlates with the increasing interest in IDP solutions offered as elements of Enterprise Automation solutions.

The Accounting related use case group also grew strongly in 2023. Accounts Payable applications are the predominant use cases as they are targeted by Capture vendors with simple invoice recognition solutions, IDP vendors with more sophisticated invoice processing solutions and enterprise automation vendors with end-to-end automation P2P processes.

VERTICAL MARKETS

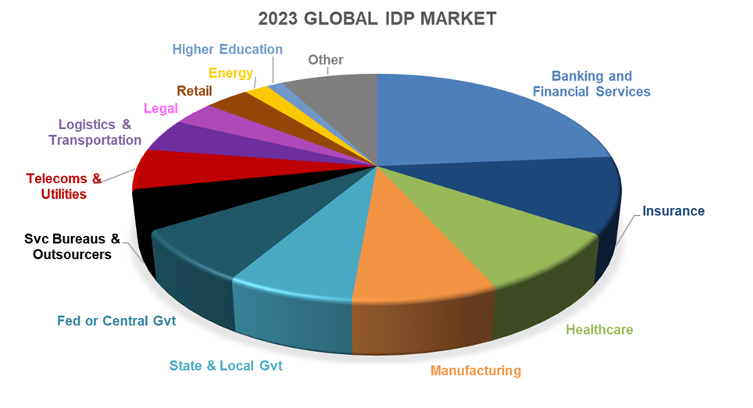

In the Global IDP market, the Finance segment (including Banking and Financial Services combined with Insurance) continued to represent the largest industry sector in 2023. Both segments experienced double digit growth YOY.

The Public Sector consists of Federal, State and Local Government (incl. grade schools). Investments in the Federal Government subsector grew at double digit rates, while Local and State government agencies continued to struggle with budgets and have been slower to embrace digitalization efforts.

The Healthcare segment continued its recovery after the pandemic with strong double-digit group in 2023.

The Manufacturing industry increased its growth rate YOY, as it recovered from challenges caused by the pandemic and the following supply chain issues.

Second tier verticals with a growth rate above the industry average in 2023 were Retail, Telecommunication & Utilities, and the Energy sector. Demand from Service Bureaus and BPOs also grew strongly, highlighting the ongoing strong interest in outsourcing services.

CAPTURE INPUT SOURCES

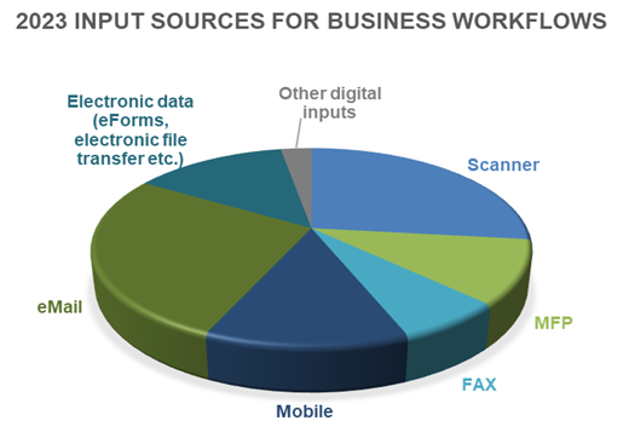

After the transformative shift of business transactions from face-to-face interactions involving paper-based documents to virtual communications involving digital exchanges of business inputs during the pandemic, the mix of input types has stabilized in the past two years.

It is important to note though that the sources and types of business inputs vary materially by use case and geography. Influencing factors are the overall level of digitalization in each country, driven by the culture and government guidance, enterprise and sector digitalization efforts, as well as regulations.

In our analysis of input sources, we see a decline in investments in IDP solutions involving input channels for the ingestion of paper-based documents, i.e. scanners and MFPs. A growing number of IDP deployments in 2023 involved inputs received via email and electronic data channels. Smart devices also continue to gradually increase in importance as input channels for business transactions like electronic banking. One of the major impacts on the input mix is the adoption of B2B e-invoicing. In countries where e-invoicing mandates have gone into effect, structured digital inputs replace paper or pdf invoices.

CAPTURE SOFTWARE FORECAST

Based on our assessment of market drivers and inhibitors outlined, there is a significant potential for the IDP market in the forecast horizon and beyond. The level and timing of the demand for IDP solutions depends on the respective level of digital maturity in a particular geography, vertical or even organization coupled with the current and planned deployment of GenAI technology.

In our forecast of the IDP market demand we consider the further development of Generative AI solutions, including its technical capabilities for core IDP capabilities like document classification and data extraction as well as the automation of complex business processes by far the strongest group of market drivers. In the mid-and long-term we expect the new and expanded capabilities to drive increased market demand.

However, in the short-term the cost associated with the deployment of GenAI as well as the speed of development of specialized language models and the emerging legislation have a potential of delaying investments.

In our forecast for the global IDP market we predict a double digit CAGR for the 2023-2028 planning horizon with an acceleration of growth rates, in particular in the base and optimistic scenarios.

INFOSOURCE CAPTURE SOFTWARE DIVISION

Infosource is the leading analyst firm for Intelligent Capture and IDP Software market analysis and consulting with more than 20 years of experience in this field.

This blog post is an extract of the 2023–24 Global State of the IDP Industry Market report, one of the major elements of the Infosource Software analyst services. It provides an in-depth assessment of the Capture and IDP software and solutions market with actuals through 2023 and forecasts through 2028.

Please contact Petra Beck at [email protected] or +491704567908 to discuss how the Infosource IDP Services can help you grow your business.