KEY TAKEAWAYS

- Global IDP spending exceeded USD 8 billion in 2024, up ~14.5% YoY, driven by process digitalisation, GenAI-enabled classification and extraction, and rising demand for end-to-end automation.

- Forecast: Infosource projects a ~16% CAGR for 2025–2029, with acceleration in the latter half as domain-tuned models scale and agentic automation moves beyond pilots.

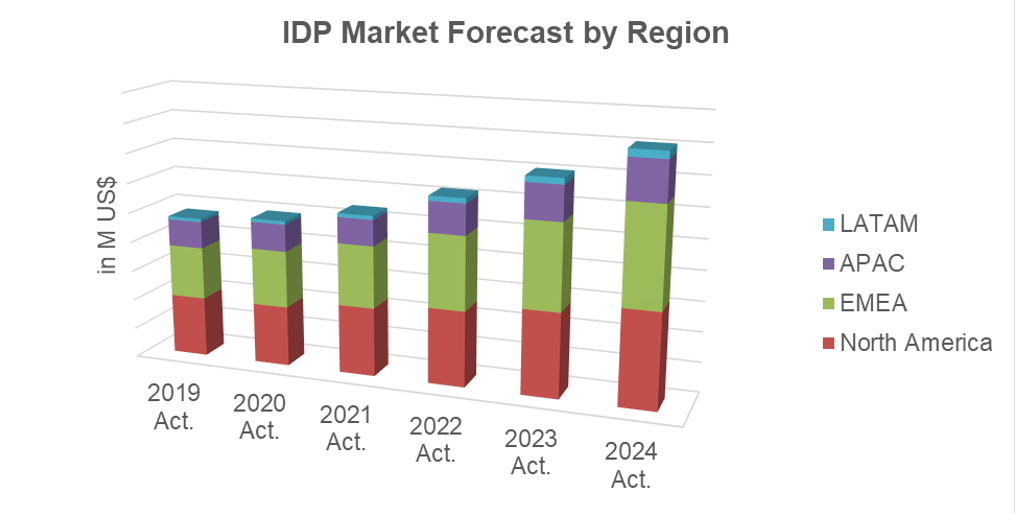

- Regional View: North America and EMEA lead (~40% each); APAC shows strong momentum; Latin America posts fastest growth from a smaller base.

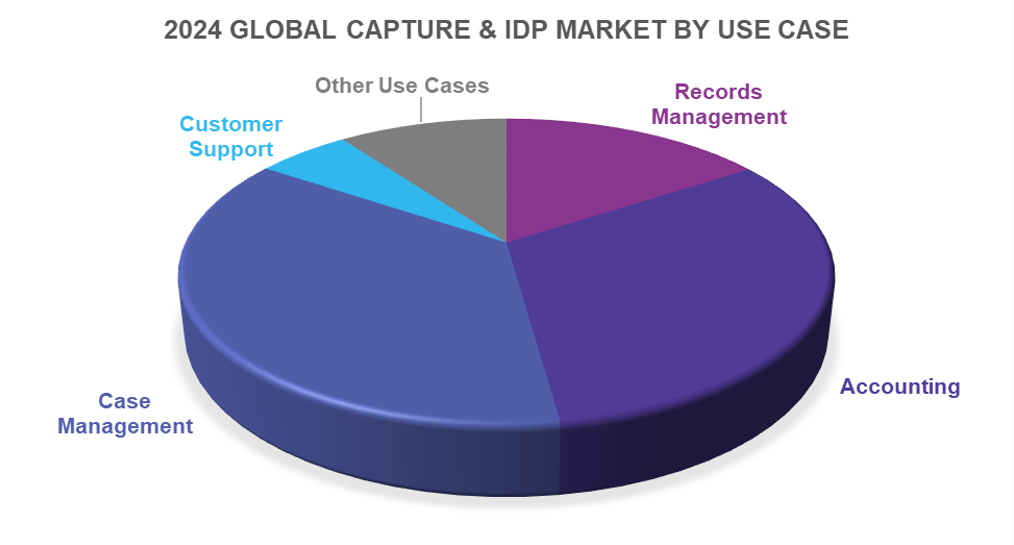

- Use Cases: Case Management dominates; Accounting remains significant; Customer Support is the fastest-growing category.

- Vendor Landscape: Traditional capture providers are losing ground; strongest growth from vendors delivering GenAI- and agentic-enabled end-to-end automation.

- Strategic Implication: IDP is becoming a core enabler of enterprise automation; differentiation depends on governance-ready, AI-driven solutions integrated into business processes.

IDP MARKET FRAMEWORK

Infosource defines the Intelligent Document Processing (IDP) market as software and services that acquire, classify, validate, and transform business inputs—structured, semi-structured, and unstructured—into reliable data for transactions, analytics, records management, and compliance.

Inputs increasingly arrive through omnichannel digital pathways such as email, portals, APIs, and chat, and include documents, text messages, images, and even audio/video artifacts.

The ecosystem spans tools and SDKs, IDP platforms, and enterprise automation suites that embed IDP into broader workflows. Deployment models range from on-premise to private cloud and cloud-native SaaS, often with API-based access to AI models.

Governance, observability, and model lifecycle controls are now critical selection criteria, as enterprises seek solutions that balance automation speed with compliance and risk management.

Trends shaping the IDP market

GenAI and Agentic Automation: Generative AI has become a core enabler of IDP performance, reducing reliance on templates and enabling contextual understanding of unstructured and multimodal inputs. Beyond extraction, GenAI supports summarisation and knowledge base creation, improving downstream automation.

The next stage—agentic automation—introduces AI agents capable of planning and executing multi-step workflows under enterprise guardrails. Adoption will hinge on governance maturity and integration readiness.

Domain-Tuned Intelligence: Organisations increasingly deploy specialised language models and retrieval-augmented generation (RAG) to balance accuracy, cost, and compliance, particularly in regulated sectors such as finance and healthcare.

Integration and Orchestration: IDP is converging with process automation, decisioning, and analytics. Buyers prioritise platforms that combine IDP with low-code tools, process mining, and observability to deliver measurable outcomes.

IDP Market size and forecast

The global Intelligent Document Processing (IDP) market reached USD 8 billion in 2024, representing a 14.5% year-over-year increase. This growth reflects sustained demand for automation across industries and the expanding role of AI in processing unstructured and multimodal inputs.

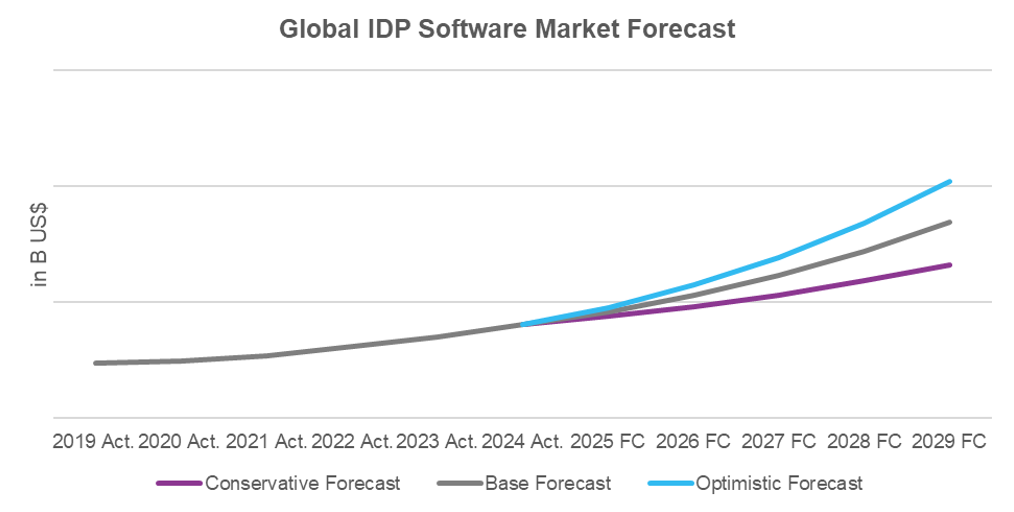

Infosource projects a CAGR of approximately 16% through 2029, with acceleration expected in the latter half of the forecast period as organisations scale GenAI-enabled workflows and begin adopting agentic automation at enterprise level.

Our analysis considers three scenarios:

- Base Case: Steady adoption of GenAI and gradual rollout of agentic capabilities, supporting strong, sustained growth.

- Optimistic Scenario: Faster regulatory clarity and rapid scaling of AI-driven automation, pushing growth rates above baseline projections.

- Conservative Scenario: Extended skill gaps and governance challenges, causing a temporary slowdown before recovery in the latter years.

Regional Development

North America remains the largest IDP market, supported by mature automation ecosystems, strong data governance frameworks, and rapid scaling of GenAI-enabled workflows.

EMEA demonstrates steady growth, with Western Europe advancing under stringent compliance requirements and the Middle East emerging as a high-growth subregion driven by government-led digital transformation initiatives.

Asia-Pacific continues to accelerate, fuelled by modernisation in large economies such as India and China, alongside advanced deployments in Japan, Australia, and Singapore.

Latin America posts the fastest growth from a smaller base, driven by digital banking, fintech innovation, and public-sector modernisation programs.

IDP USE CASES

Case Management remains the largest use case category, expanding at a strong double-digit rate as enterprises automate onboarding, claims, and other transaction-heavy workflows. Its scale reflects the complexity of processes that require both structured and unstructured data handling.

Accounting follows closely, driven by the shift from invoice capture to full procure-to-pay (P2P) and order-to-cash (OTC) automation. GenAI capabilities are enhancing exception handling, reconciliation, and analytics, making this segment a priority for finance transformation initiatives.

Customer Support is the fastest-growing category, as organisations integrate IDP with contact center and service workflows to improve response times, reduce manual effort, and enable personalised interactions.

Records Management remains smaller in revenue terms but strategically important for compliance, audit readiness, and knowledge base development—particularly in regulated industries.

VERTICAL MARKETS

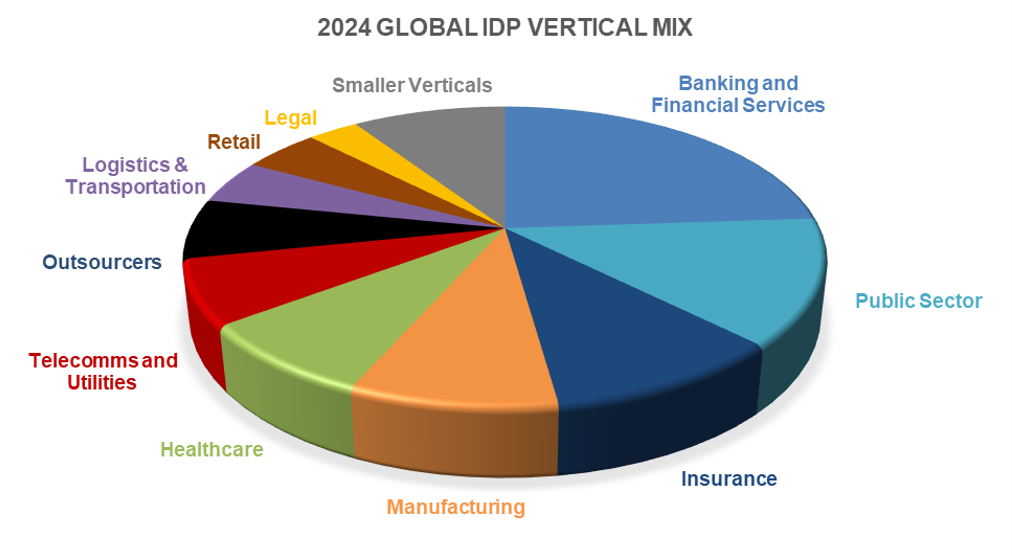

Finance remains the largest vertical for IDP adoption, driven by automation of onboarding, KYC, compliance, and risk processes. The sector’s regulatory intensity and high transaction volumes make it a natural fit for GenAI-enhanced document processing.

Insurance follows closely, applying IDP and GenAI to claims intake, underwriting triage, and regulatory correspondence—areas where speed and accuracy directly impact customer experience and cost efficiency.

Public Sector continues to invest in benefits administration and citizen communications, though adoption varies significantly by region depending on digital infrastructure and policy mandates.

Healthcare is accelerating IDP deployment in revenue cycle management and clinical documentation, with governance and privacy requirements shaping solution design and vendor selection.

Manufacturing, Retail, and Logistics are expanding IDP use for supply chain documentation, quality compliance, and customer engagement, reflecting the need for real-time data exchange across global networks.

BPOs and service providers remain key adopters, leveraging IDP to differentiate through domain expertise and SLA-driven automation.

INPUT SOURCES & Omnichannel Trends

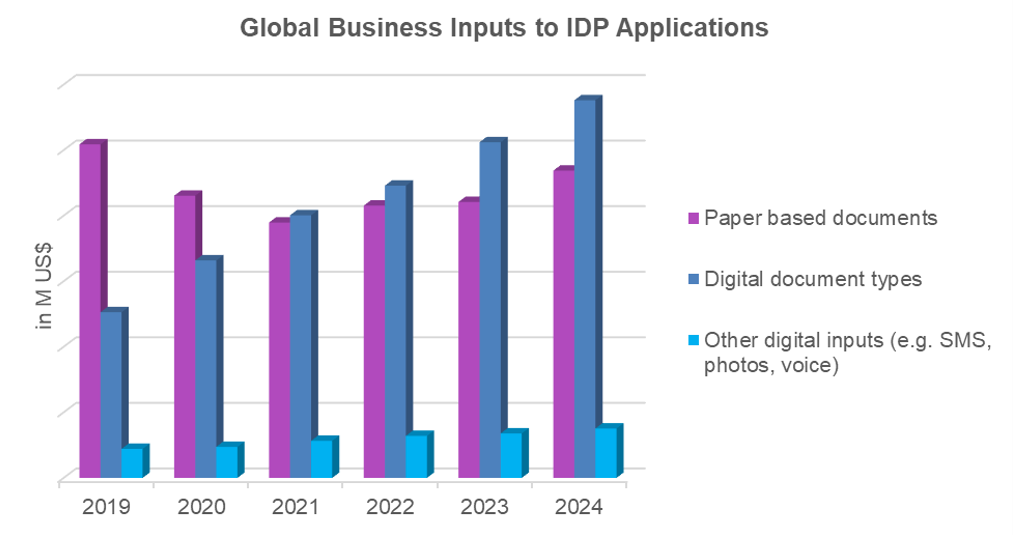

The input mix continues to shift toward digital-first channels. While paper-based inputs remain relevant in regulated workflows, most new deployments prioritise email, portals, and API-based integrations.

GenAI accelerates the transition to multimodal intake, enabling unified handling of text, images, and voice without the need for separate OCR or NLP modules. Regulatory changes such as e-invoicing mandates reduce reliance on traditional invoice capture but expand adjacent processes such as exception handling and supplier communications.

ABOUT INFOSOURCE’S SOFTWARE PRACTICE

Infosource is a globally recognised analyst firm specialising in the IDP software market. Our bottom-up assessments track hundreds of vendors worldwide, combining direct vendor inputs with channel intelligence and qualitative research. We benchmark capabilities across our IDP Maturity Model, evaluate use-case traction, and produce regional and sector outlooks to support planning and execution.

This blog post is a high-level extract from the State of the Global IDP Market 2025 Report, which includes detailed forecasts, vendor maturity analysis, and regional and sector deep dives.

Contact: Petra Beck — [email protected] | +49 170 4567908

Interested in the full report or tailored insights for your organisation?

Contact us to discuss your priorities and how Infosource can help you identify growth opportunities, refine go-to-market strategies, and scale AI-powered automation initiatives.