Geneva, Switzerland – August 26, 2022

WEU, EEU INKJET PRINTERS MARKETS IN THE FIRST HALF OF 2022

- THE WESTERN EUROPEAN MARKET

1.1. MARKET STATS

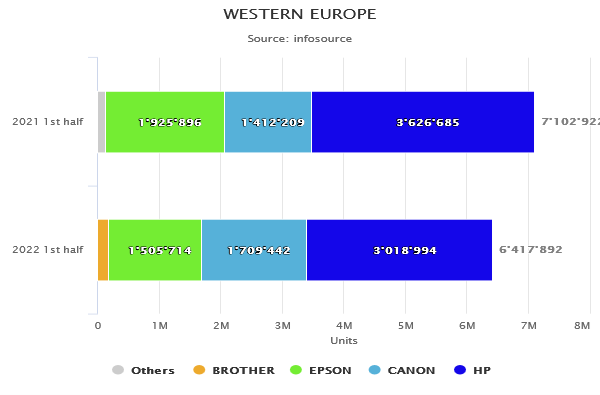

The total West European inkjet printer market experienced in the first half of 2022 a double-digit decrease of 10% compared to the first half of 2021, to the level of approx. 6.4 million units. Most WEU country markets registered decreases, led by declines in the largest markets, setting the downward trend for the total WEU market. However, as usual, the total inkjet printer market in H1 2022 was still much larger than the total toner copier/MFP market in WEU, by 5 million units (approx. 6.4 million inkjet units compared to around 1.5 million toner copier/MFP units).

The largest French market (20% share of the total market) decreased by 12%, at the same decrease rate as the second-largest market of the United Kingdom (18% share), while the third-largest German market (18% share) declined only by 5%. The fourth-largest Italian market (11% share) went down 14%, while the largest increase by the rate of 17% took place in Sweden (3% share).

Multifunctional (MF) inkjet printers dropped 9% and accounted for a 95% share of total inkjet sales in H1 2022 (in Eastern Europe, MF registered a 90% share). Single function (SF) inkjet unit sales decreased by 26%. The home/consumer personal market was down 8%, while the business market was down 14%. The business market share from the total inkjet market in H1 2022 was 28% (in Eastern Europe, this share was 13%).

The total ink tank market (CISS – Continuous Ink Supply System) continued a strong increase trend with a growth of 28% to about 1.3 million units. This increase was created by the solid growth of HP, which overtook the market leader of this specific market – Epson, due to the increased sales of its DeskJet Plus and Smart Tank line-ups in H1 2022.

In terms of A3 sales, this important market (from a revenue point of view) registered a decreasing trend of 8%, which was reflected in the majority of the markets in Western Europe, with the only exception of France (the third largest market increased 4%). The A3 sales decreases have occurred in Germany (8%), the United Kingdom (9%), Italy (7%) and Turkey (37%). Within the A3 inkjet market, the CISS share was 18%, with Epson traditionally holding practically the total share of 99.9%, with unit sales up by 23% in H1 2022. Brother is the only other brand present in this specific market, in second place with an invisible share of 0.1% with the model MFC-T4500 DW.

1.2. BRANDS

In terms of brands, there was a change in H1 2022 compared to H1 2021, signalized already in H1 2021, when Canon, with an increase of total unit sales by 21% surpassed Epson at the second place. HP retained its No. 1 position for total inkjet sales despite a decrease of 17% when HP home/consumer personal sales were down by 17% and business-class down by 15%. HP sales of CISS devices (introduced to the market in 2016) went up by 89%, and the total CISS sales still represented 20% of HP’s total inkjet sales in WEU. HP continued to heavily promote its “Instant Ink” program in several countries of the region when the customers subscribe for a timely cartridge replacement service when the device runs low on ink (the printer sends ink level information to HP).

Canon’s total market share was up by approx. 7% in H1 2022 with a 21% increase in total unit sales, home/personal inkjet sales plus 21%, and business category up 29% to the level of approx. 80k units. Canon sales of CISS devices increased by 49% and accounted for 7% of Canon’s total inkjet sales in FY 2021.

Epson’s total market share decreased by 4% in H1 2022, Epson’s total sales decreased by 22%, with its home/consumer personal inkjet sales down 25%. Business category sales decreased by 19%. As already mentioned, Epson was surpassed at the second position by Canon and finished in the 3rd overall position. CISS sales were down by 6% to 577k units and represented 38% of Epson’s total inkjet sales. Epson introduced to the market in H2 2021 several new models of the EcoTank line-up.

Brother’s total market share improved by 1% in H1 2022 due to an increase in unit sales by 33%. Its home/consumer personal inkjet sales increased by 126% due to the introduction of new models in H2 2021, while the business segment sales increased by 16%, while CISS sales remained at the same level as in H1 2021.

1.3. MODELS

Within the home/consumer personal devices market, HP has placed seven models within the top ten, with the top three places taken by DeskJet 2755 e-AiO, DeskJet 2720 e-AiO and DeskJet 2710 e-AiO. The Same situation occurred in the business class category, where HP also managed to place seven models in the top ten. The top three models were Envy Inspire 7224e Aio, OfficeJet Pro 9010 All-in-one and Envy Inspire 7255e AiO. Epson put three models within the business top ten, with EcoTank ET-M1120 at 8th position, followed by EcoTank ET-M1140 and EcoTank ET-M1100. In the CISS category, another similar situation as HP placed six models and Epson four models, with the top three being HP’s DeskJet Plus 4155, DeskJet Plus 4130 and DeskJet 4122.

- THE EASTERN EUROPEAN MARKET

2.1. MARKET STATS

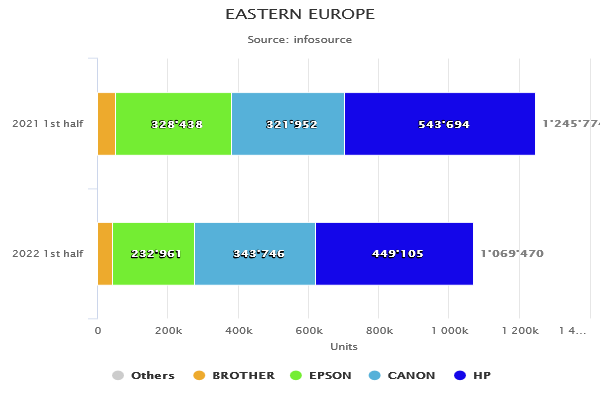

The total East European inkjet printer market in H1 2022 decreased by 14% to 1.1 million units (the total inkjet printer market was larger than the total toner copier/MFP market by approx. 250k units). For a broader view, the entire East European inkjet market represented about 17% of the whole Western European inkjet market in unit sales.

Overall the trends were positive in most of the Eastern European markets when most of the country markets registered significant increases in inkjet unit sales. However, the formerly largest Russian market contracted by 56% compared to H1 2021 and sent the whole EEU market into a decreasing trend. Due to this decrease, Russia also lost in H1 2022 for the very first time its first position as the largest EEU marked and finished “only “in third position behind Poland (7% increase) and the Czech Republic (9% increase).

The multifunctional (MF) inkjet printer market decreased by 13% and represented 90% of the total inkjet market (in Western Europe, MF represented 95%), while single function (SF) printer sales decreased by 26%. The home/consumer personal market in H1 2022 declined by 11%, while the business market was down 32%.

The business market share of the total inkjet market in H1 2022 was around 13% (in Western Europe, this share was 28%, as mentioned above). The entire ink tank (CISS) market increased by 16%, while the inkjet A3 market was up 9%. Within the A3 inkjet market, the CISS share was 46%, with Epson as the only dominant brand in this category (99.9% share, Brother 0.1% share with model HL-T4000 DW), when the A3 CISS unit sales increased from 6k to 13k units.

2.2. BRANDS

In terms of brands in H1 2022, HP managed to comfortably secure its number one position in the total inkjet market, as in the previous periods. In EEU, Epson was forced to cede its second position to Canon (in WEU, it was vice versa).

HP registered a 17% sales decrease in total sales in H1 2022. Its home/consumer personal inkjet sales decreased by 16%, while its business-class inkjet sales were down by 30%. HP’s sales of CISS devices were up by 16% (approx. 130k units) and represented 29% of HP’s total inkjet sales in EEU.

Canon’s market share increased 7% in H1 2022 due to an increase in unit sales of 7%, as did the home/consumer personal inkjet sales, when the business-class inkjet sales remained at the same level as in H1 2021. On the other hand, Canon’s sales of CISS devices decreased by 15% and accounted for 27% of total Canon’s inkjet sales.

Epson’s market share decreased 5% in H1 2022 because of a 29% sales decrease. The home/consumer personal inkjet sales declined by 25%, but the business segment sales decreased by 35% to approx. 136k units, but still securing Epson the No. 1 position in the business inkjet market with 63% share. Epson’s CISS sales went down by 28% to 218k units and secured Epson the No. 1 position in this market. The CISS sales represented 94% share of Epson’s total inkjet sales.

Brother’s market share remained at 4% despite a unit sales decrease of 16%, with home/consumer personal inkjet sales down 17%, while business inkjet increased by 7%. Brother’s CISS sales registered a decrease of 19% and represented an 88% share of Brother’s total inkjet sales within EEU.

2.3. MODELS

Within the home/consumer personal devices market, HP managed to place six of its models from the DeskJet line-up within the top ten best-sellers. However, the number one position was taken by Canon’s PIXMA TS 3350 BL. In the business inkjet category, Epson placed seven models in the top ten, with top-six models and number one best-seller EcoTank ET-M1120. In this category, HP placed three models – OfficeJet 8013 e-AiO at 7th, OfficeJet Pro 9010 All in One at 9th, and OfficeJet Pro 8022 AiO at 10th place. In the CISS category, Epson had “only” three models, as did Canon, HP placed four models in the top ten, but the No. 1 best-seller was Canon Pixma G 3411 followed by Pixma G 3420.

- SUMMARY

Both the total WEU and EEU inkjet markets in H1 2022 registered double-digit decreases, which is not a typical situation for the inkjet segment, even though some markets in WEU are getting to be saturated. The first half of this year was characterized by the impact of many negative factors from last year, which continued to intensively disrupt the normal market functioning, plus some new elements emerged in H1 2022. Significant disruptions were caused by Covid-related complications (differences in vaccination procedures), factories and warehouses closures, lengthy distribution disruptions, microchips, semiconductors and other components shortages, and unstable exchange rates, to name a few. All of this was amended in February by the Russian invasion of Ukraine with connected sanctions and Russian countermeasures and created highly volatile, unstable and unpredictable business conditions worldwide.

One of the leading inkjet brands, Epson, recently got a complaint from a dissatisfied customer who took to Twitter to complain that his wife’s “costly printer just gave a message saying it had reached the end of its service life and proceeded to brick itself (cease printing)”.

According to Epson, “all Epson consumer ink jet products have a finite life span due to component wear during normal use. At some point, the product will reach a condition where either satisfactory print quality cannot be maintained, or components have reached the end of their usable life. This is the normal product life cycle for highly mechanical devices like printers. This message is a warning that certain parts have reached the end of their usable life and that your printer will no longer work until it is serviced.”

To clear up any misconceptions regarding the serviceability and lifecycle of Epson printers, Epson added that there are now four options for customers who receive the alert. Epson understands the importance for its customers to be able to print whenever they need to and offers flexible options to extend printing, including:

- A one-time Maintenance Reset Utility, enabling customers to continue printing for a limited time in order to determine the repair solution that best fits their needs.

- Customers can contact the Epson Service & Support team about Epson’s low-cost ink pad replacement service, which includes shipping and packaging round trip to and from Epson.

- Customers can also work with a local certified technician to replace the ink pad to extend the use of the printer.

- For customers who determine that the printer no longer meets their needs, Epson offers a recycling program and a wide range of innovative new printing solutions.

Regarding the inkjet devices in general, stable high print quality, lower investment costs, special offerings to customers regarding ink savings, and other special incentives will support the inkjet device´s appeal to the customers in the future. The demand for multifunctional inkjet printers will remain higher than for laser devices in the home/consumer segment, especially in EEU. As for the business segment, the sales of A3 inkjet devices saw declining tendencies in H1 2022, but such trends are understood to be temporary and a sign of a messed up market, as, in both WEU and EEU, the inkjet business segment bounced back in a truly spectacular fashion in FY 2021.

Regarding the future development of the EEU market, many uncertainties lie within the Russian economy, which directly influences large regions and country markets economies. Due to the Russian military invasion of Ukraine, and applied economic sanctions, draining of foreign investments (but of course also because of other perennial problems plaguing the Russian economy), the market has been in fundamental confusion since Q2 2022, which will undoubtedly continue in H2 2022 and then further.

Petr Kramerius, Regional Manager

e-mail: [email protected]