Key Takeaways

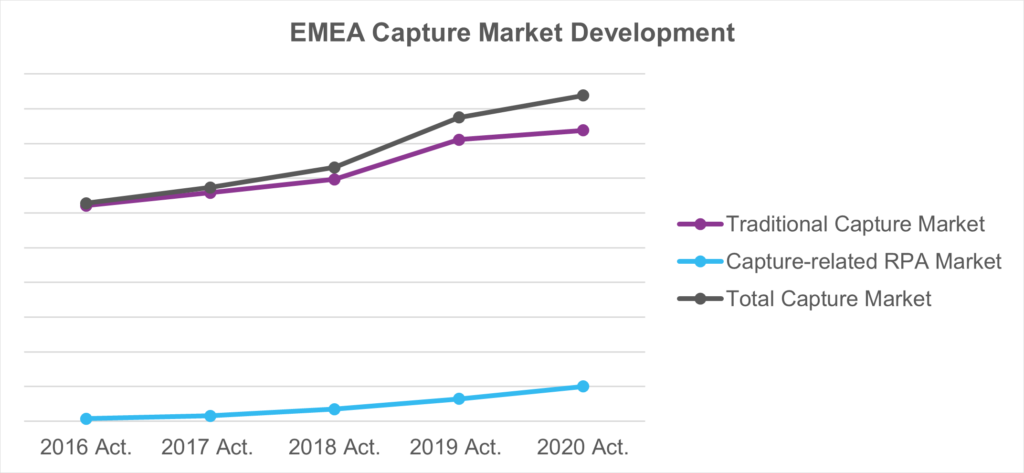

- The Capture Software market in EMEA grew by high single digits in 2020.

- The pandemic has accelerated several dynamics that were under way in the past few years including the shift to front-office capture applications, growth of Case Management capture use cases, and the shift to digital and multi-channel business inputs

- The market demand for RPA solutions with Capture capabilities will continue to be strong but mature over the forecast period. Infosource predicts a growing convergence of the Intelligent Information Capture market and the RPA segment.

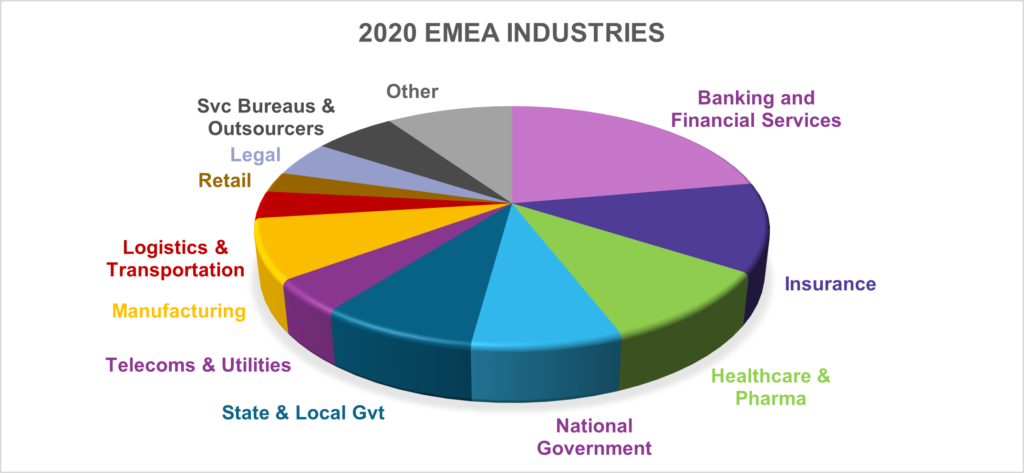

- The Finance and Public sectors continue as the largest verticals and are expected to continue their investments in Digital Transformation. In the next five years we expect a growing demand in the Manufacturing sector as well as the Telecommunications and Utilities verticals.

The Evolution of Capture

Capture Software is used to process business inputs. It understands and extracts meaningful, accurate, and usable information from these inputs. The underlying technologies may include traditional recognition and extraction, AI-based recognition and NLP technologies, and RPA and other workflow automation technologies, often including machine learning

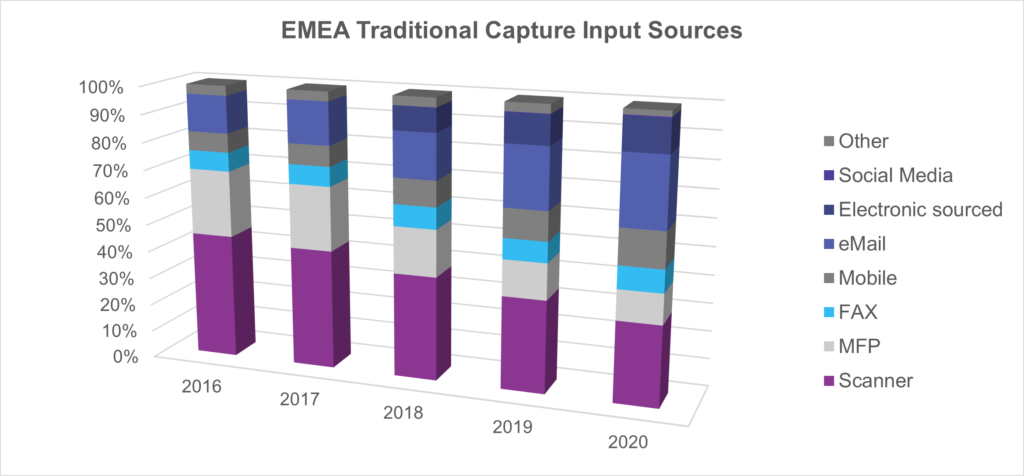

Historically business inputs have been primarily received as paper documents which needed to be digitized and converted into usable, validated data, but they have increasingly shifted from paper and to a variety of digital sources including email, fax, smart devices, and social media. Inputs can include not only documents and other text-based sources, but also voice, photos, videos, and IoT channels. All inputs are interpreted to understand the content, and where and why it is needed. Data is extracted, validated, and augmented to drive transactions, comply with records management requirements, or facilitate customer communications.

Impact of the COVID-19 Pandemic on the Capture Software Market

Demand for Capture Software market in the EMEA region which encompasses Western and Eastern Europe, the Middle East and Africa grew by solid double digits in 2019; the demand for the digitalization of information-intensive business applications was augmented by a strong interest in RPA solutions and the final deadline of the GDPR privacy law in Europe that generated an increasing demand for traditional Capture solutions. In 2020 the growth slowed as organizations had to pause implementations due to lock-down directives or delay investments. The demand for traditional Capture solutions grew slightly in 2020, sales of Capture-related RPA solutions still increased by 50% YOY.

Infosource analyzes the Traditional Capture market based on two major segments. The back-office/batch segment and front-office Capture, where business inputs are captured at the earliest point of entry. The front-office segment now represents the largest segment in the EMEA region and is expected to account for the strongest and growing demand going forward.

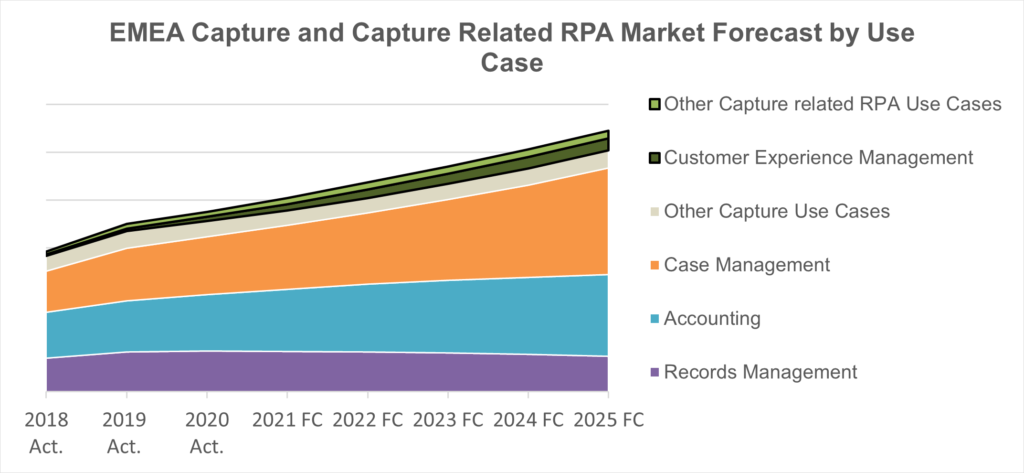

In the use cases both for traditional Capture solutions and RPA solutions, the pandemic accelerated the demand for Case Management solutions, which consist primarily of onboarding and claims management use cases. Accounting applications, where invoice processing continues as the major use case increased somewhat in demand, while Records Management applications, in particular back-file conversion projects slowed and were partly delayed.

Input sources for business transactions that used to be largely paper based five years ago, continue to shift to digital inputs. However, it is important to note that the growth of Capture solutions is primarily driven by additional digital input types and secondarily by the replacement of analog inputs. The graph below highlights the decline of input sources used to digitize analog documents (i.e., Scanners and MFPs) and the increase of digital inputs (i.e., email and electronic sourced inputs) caused by B2C interactions being limited by lock-down measures in many countries in the EMEA region last year. The increasing inputs submitted through mobile devices also reflect the increasing trend of end customers submitting inputs and documentation through their smart phones. Inputs through fax machines also increased slightly, addressing the submission of business inputs directly from end customers or in B2B transactions.

The reduced shipments of MFP and Single Function Scanner shipments in 2020, both markets tracked by Infosource, support this trend.

Capture Software Forecast

Over our five-year forecast period, 2020-2025, Infosource expects the Traditional Capture Software market to accelerate its growth compared to 2020. In the RPA market, we expect Capture capabilities to play a stronger role.

The automation of front-office business applications will continue to increase driven by the desire to accelerate and optimize transactional processes, which will drive a strong increase in Capture solutions that automate the ingestion of business inputs in transactional type solutions.

From a use case perspective, the most significant growth in market demand is expected in Case Management, as organizations seek to automate their business transactions, e.g., customer / patient / employee onboarding and claims / mortgage applications. Records Management as the primary reason for Capture will continue to decline; however, the smaller elements of this Use Case segment, Analytics and Discovery, will present growing opportunities. Accounting has been and will continue to offer a key opportunity for Capture solutions and increasingly RPA solutions. (See Graph below)

Vertical Markets

In the EMEA, the largest industry segment is Finance, consisting of Banking and Insurance, which accounts for more than one quarter of the regional Capture market. The Public Sector, consisting of Government agencies ranging from National to State and Local Government is the second most important market. (See graph below)

The pandemic caused a decline in Capture solution investments in Retail and Manufacturing driven by lockdown measures in 2020. Investments increased in State & Local Government and Telecoms & Utilities, the latter saw a spike in demand to accommodate communication changes during pandemic.

In the next five years the Finance Industry (Banking and Insurance) and the Public Sector will continue as the largest verticals in the Capture Software market. The State & Local Government sector, as well as the Manufacturing space are expected to outpace the overall market. Country governments and the Finance sector, which are further advanced in digitalization, are expected to grow below average.

Capture Opportunity by Geography

The Capture Software market in the EMEA geographies represented over one third of the global market in 2020. The Information Capture market in the region is rather diverse in terms of maturity. Western Europe, the more mature subregion, accounts for the vast majority of the current market revenue, while Eastern Europe, the Middle East and, particularly, the African countries are in an earlier stage of adopting Information Capture solutions. Within Western Europe the Scandinavian countries are most advanced while large geographies like Germany are at a lower-level digital maturity, in particular as it relates to the Public Sector.

Infosource Capture Software Division

Infosource Software is the leading authority on Capture systems and provides analysis and guidance on the Capture software market, which covers the use of Artificial Intelligence-driven pattern recognition technologies to provide a business understanding and extraction of data from unstructured and semi-structured ‘human understandable’ inputs.

This 2020–21 EMEA Capture Software Market Analysis is an element of the global Infosource Capture Software analysis. It provides an in-depth assessment of the Capture opportunity in Europe, Middle East and Africa.