Infosource forecasts future growth in Desktop Workgroup & Departmental distributed document scanners in coming year

Infosource’s recently published World-Wide Distributed Document Scanner Forecasts shows unit growth in the Desktop Workgroup and Departmental scanner segments through 2025. Overall, Desktop Workgroup scanners will see the bulk of shipment growth in the coming years as companies shift from paper-based workflows to digital workflows that integrate to a CRM or BPM system. The pandemic has revealed the gaps in automation and will accelerate the push to digitization in the office.

Europe & the MEA

As the vast majority of the scanner shipment volume is in the Distributed sector its only logical that developments in this sector will give a good indication to how post-Covid recovery is proceeding.

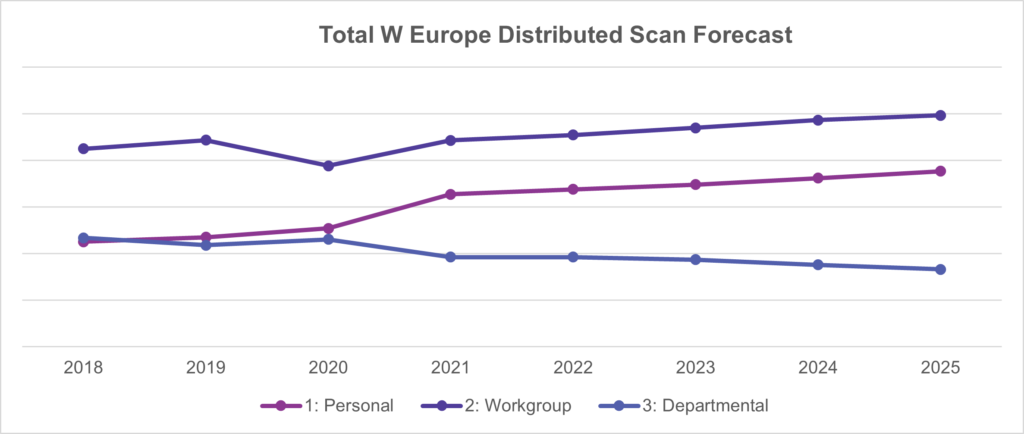

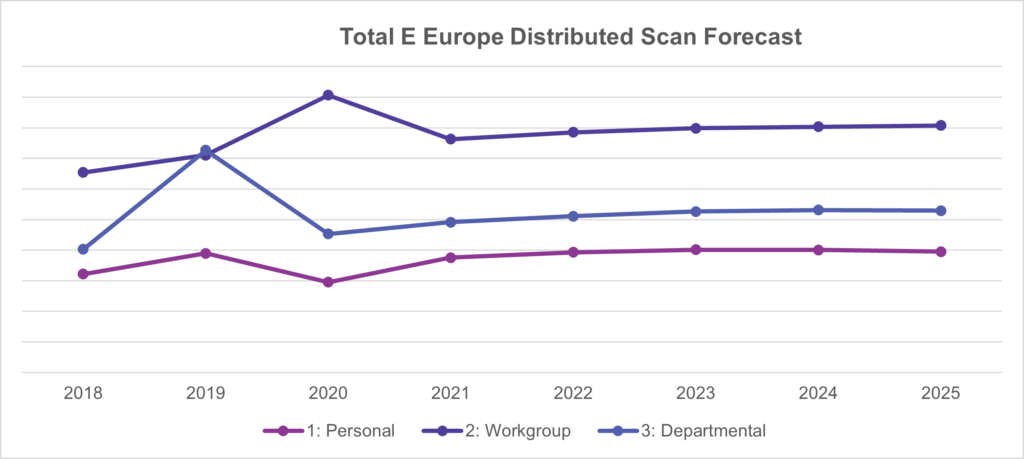

When contrasting Western Europe and Eastern Europe one particular aspect which stands out is that while in Western Europe both the Personal and Workgroup categories have shown a strong post-Covid rebound, in terms of sales, the Departmental category has declined. Within Eastern Europe it is the Personal and Departmental categories which have shown a strong rebound whilst the Workgroup category has declined.

Why the regional difference? Existing product availability at the time of “lockdowns,” the availability of new product, price/performance demands of the “new” enforced home worker have all contributed. One addendum to the note on trends in the European Departmental sector – it has been suggested that the decline in the sector, although a decline which may prove not to be long term according to one high-profile vendor in the sector, is due to the lack of clear definition between the Departmental and Workgroup space in W. Europe.

From the graphics above, in both the Western and Eastern European forecasts, you can see the clear impact of the Covid pandemic on shipments across all categories over the period 2019 to 2020. Although the post-pandemic rebound is obvious from both graphics what is also clear is that over the long term (although we are forecasting consistent growth, with the exception of the W. European Departmental sector) overall CAGRs are somewhat conservative/restrained. Within Eastern Europe over the forecast period to 2025 the CAGR across all Distributed categories is expected to range from 1% – 2%. Within W. Europe the CAGR for the Personal and Workgroup categories will range from 3% – 4% with the Department category currently forecast to decline.

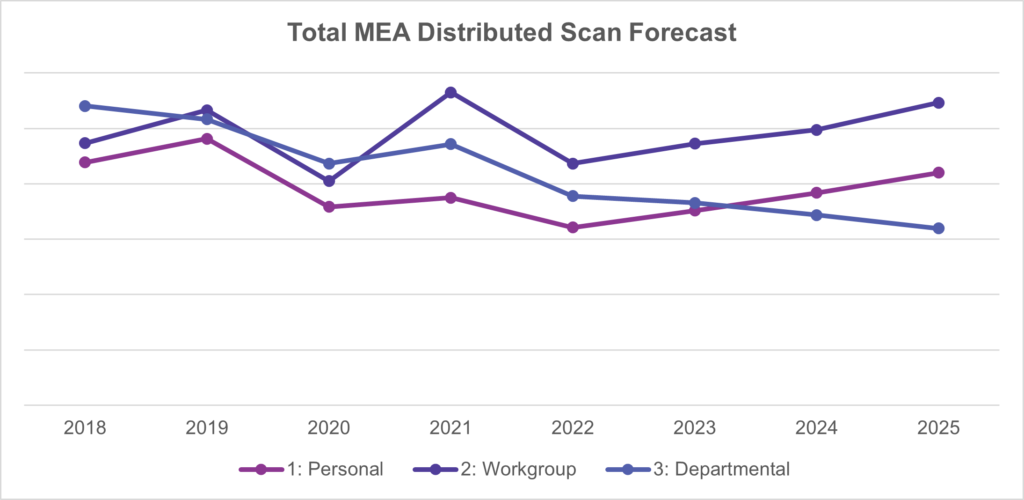

Across the MEA the post-pandemic rebound has been the most dramatic of all the regions under consideration here. The MEA region, as a whole, tended to react early to prevailing WHO advise on lockdowns which in effect has enabled them to be first out of prevailing restrictions. There was a significant post-Covid sales rebound across all Distributed scanner categories. Within the Workgroup space stock availability has enabled the sales in the category to grow by 40% driven by the pent-up demand of the “new” home user.

The graphic showing the long-range forecast for the MEA region shows that the post-Covid rebound is significant during 2021. Infosource is however forecasting that from 2022 sales levels will return to pre-pandemic levels.

Over the long term the price/ performance of devices in the Personal and Workgroup sector is expected to drive consistent sales growth year upon year.

Within the Departmental sector despite a strong 8% growth in sales over 2020 to 2021 over the long term, as in Western Europe, we expected shipments in the category to decline.

North America

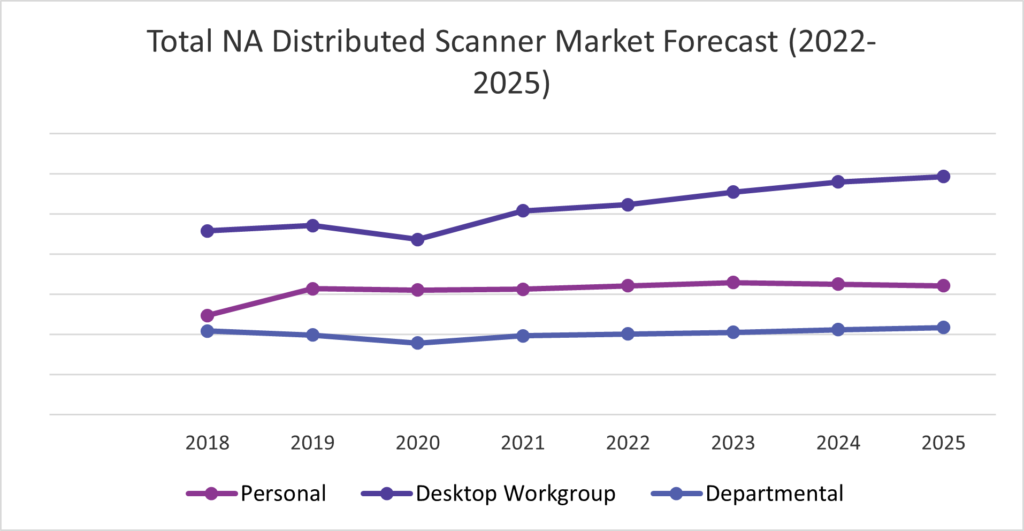

In North America, total Distributed Document Scanners are forecasted to grow at a 2.0% CAGR through 2025. The Desktop Workgroup segment makes up roughly 45% of total shipments in this category and is expected to grow at a 3.2% CAGR through the same period fuelled by the shift to digital workflow requirements. The demand for information processing equipment to support remote work/hybrid work is likely to remain strong through the forecast period.

Infosource is expecting that the demand for Departmental scanners in North America will improve during the next few years as regulatory compliances spur shipment growth. Infosource forecasts Departmental scanners to grow at a 2.0% CAGR through 2025. Additionally, new guidelines for digital files such as the U.S.’s (FADGI) Federal Agency Digitization Initiative for archive records could be a bright spot for growth opportunity in this region.

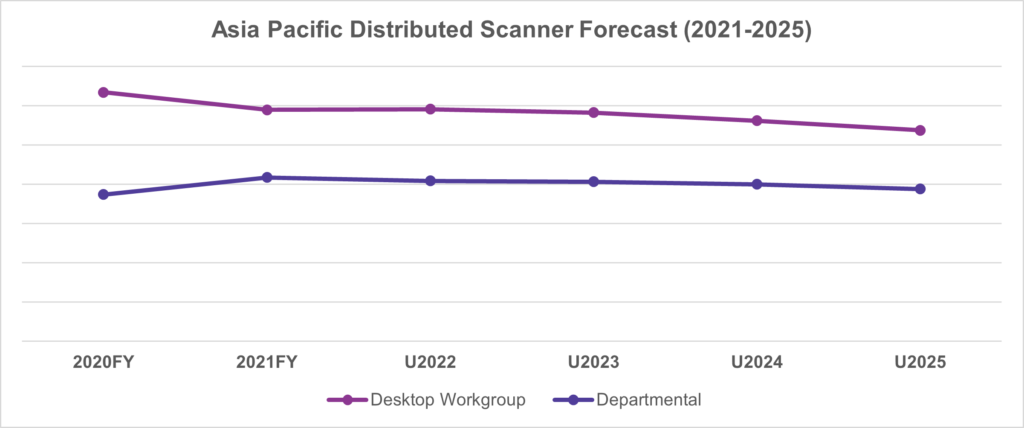

Asia Pacific

In this region, the status of IT infrastructure and broadband accessibility varies greatly from country to country, with economic conditions, differences in national disposable incomes, and PC penetration rates also influence scanner demand. Overall, Workgroup scanners account for roughly 45% of the total devices shipped. While Departmental scanners make up 29% of the total, however this percentage varies widely by country.

Within the emerging countries of Asia-Pac, the volume of documents (electronic or paper) is expected to increase due to the increased volume of transactions in business and daily life as a result of continued economic development. While in the developed countries, the demand for scanners has been flat or declining due to the SDGs movement; the development of cloud services to promote paperless business, and the development of capture software a trend, that is expected to continue.

As a region, the overall CAGR in the Asia-Pac is expected to decline by -1.6% from 2021 to 2025, with Desktop Workgroup scanners expected to decline by 3% and Departmental scanners expected to decline by 0.7% through the same period.

Conclusions

What is clear from the above assessment of the sales across the global regions that there has indeed been a post-pandemic rebound. There is certainly variance between the categories on the relative strength of this rebound and which categories of device have been most and least affected.

What is less clear is whether this sales bounce will be sustained over the forecast period – the evidence from Infosource’s Document Management Scanning Program seems to be that it will not and that pre-pandemic levels of growth will prevail.

The authors of this post are Infosource’s:

Mark Nicholson, Regional Manager ([email protected])

Shinichiro Oda, Regional Manager, Asia Pacific ([email protected])

Barbara Richards, Senior Analyst ([email protected])

Photo by Morgan Housel on Unsplash