With the publication of the H2 2021 data Infosource is now in position to fully gauge the world-wide impact that COVID has had on the Document Management Scanning hardware industry (DMS).

Before we consider the major regions of the world a cursory look at European GDP growth rate figures, published by Eurostat for 2020, shows that almost all countries (the 2 most notable exceptions being Ireland and Turkey) showed negative growth rates for 2020. These figures will not be a surprise to anyone reading. However, what is probably of most interest to the readership now is the extent to which the regions are recovering – and, if so, how strong the recovery is.

This article will focus on the distributed scanner segments as a means of comparing the relative impact of disruption across the regions.

This report overview will consider three major world regions: Europe and the MEA, the Americas, and the Asia-Pac region. This article has been compiled by Infosource’s dedicated industry regional managers located in each of the regions under consideration.

Europe and the MEA: DMS Scanner H1 2020 vs H1 2021

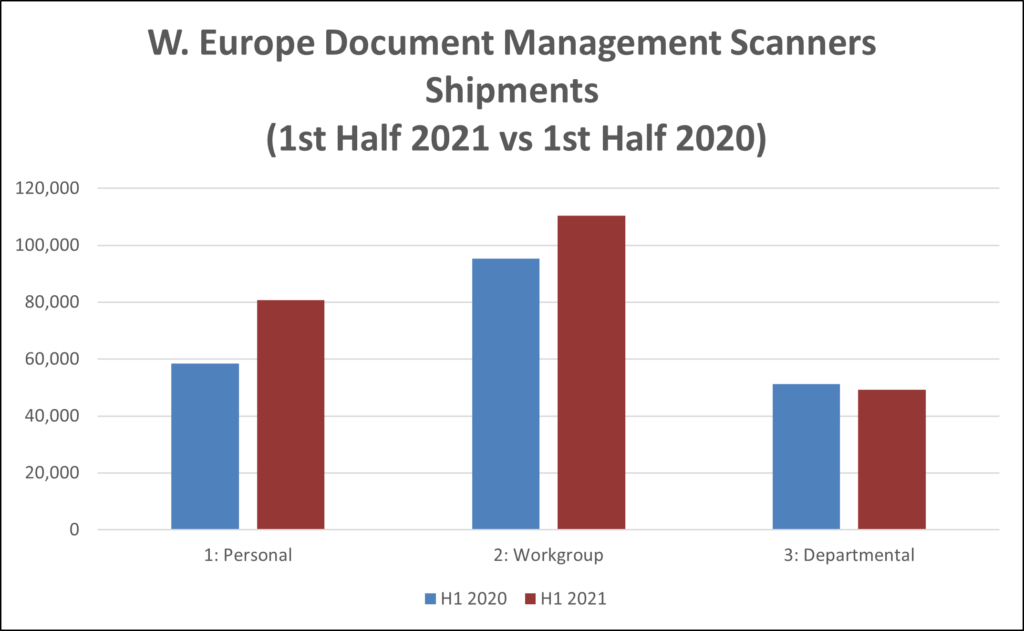

Western Europe:

Across W. Europe total DMS shipments (across all categories of device) grew by 16.7%. When H1 2019 is compared to H1 2020, the period prior to the full impact of COVID, shipments in W. Europe fell by approximately 7.4%, This is the least significant level of impact across the three subregions being discussed here.

When brand share is considered, the relative market positions of Fujitsu and Brother remained unchanged over the periods H1 2020 and H1 2021. Over these time periods Fujitsu’s market share was 33.4% vs 32.4% and Brother’s market share was 24.7% vs 26.8%. At the height of the COVID impact in 2020 Canon’s scan hardware shipments reduced by over a third, which was in large part attributed to a shortage of manufacturing components and disrupted transport logistics to Europe.

Figure 1 shows the distributed scanner segments (Personal, Workgroup, & Departmental) by volume over the periods H1 2020 is compared to H1 2021.

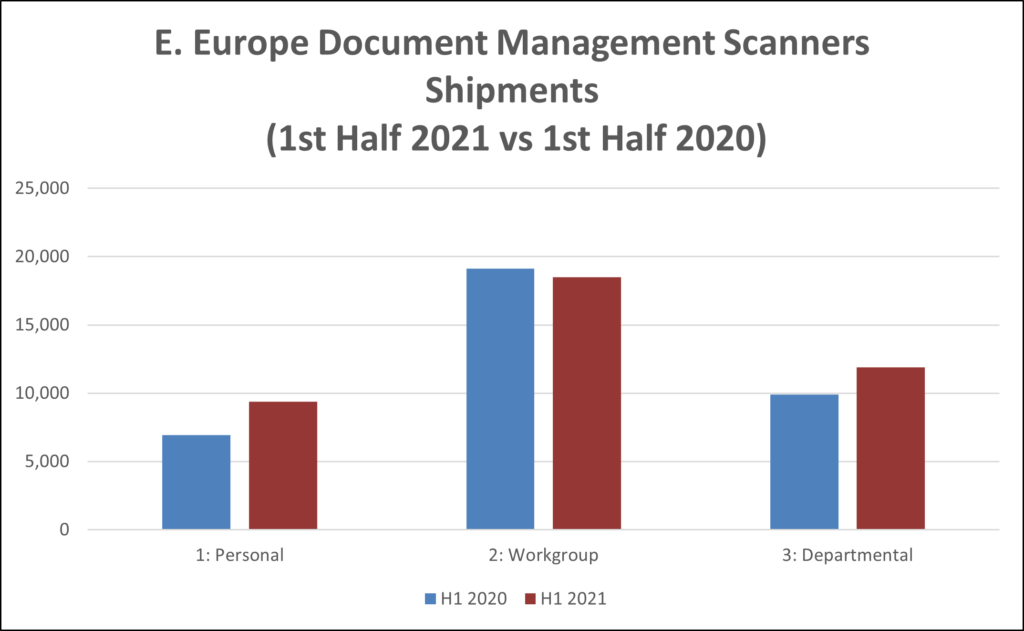

Eastern Europe:

At the height of the COVID outbreak, over H1 2020, shipments of DMS scanners across E. Europe fell by over 25.6%, which is obviously significantly more than the 7% decline in W. Europe. The H2 2021 data published by Infosource shows that over H2 2021 there has been a 11.5% growth of shipments for H1 2020 vs H1 2021; so we can say that although the fall was more significant in E. Europe than W. Europe the subsequent recovery in the region, although positive, is less substantial than in W. Europe.

What is perhaps more interesting in the data for E. Europe is focusing on what happened at a brand level. Over H1 2019 Brother was 5th in the market in relation to its shipped scanner volumes. At the height of COVID Brother shipments more than doubled, making it the overall market leader from Canon. Subsequently over H1 2021 Brother’s volume share dropped back to 5th again and Canon re-established itself as the No1 vendor for scan shipments in the region.

There are two hypotheses for this result; Brother’s stock levels of its SOHO devices in E. Europe were far less affected than other brands. However, when the other brands we able to reorganize their distribution Brother was again outcompeted. Alternatively, Brother had stock in the channel which it was able to capitalize on whilst the other brands suffered from stock acquisition and transportation.

Figure 2 below shows the distributed scanner segments (Personal, Workgroup, & Departmental) by volume over the periods H1 2020 as compared to H1 2021.

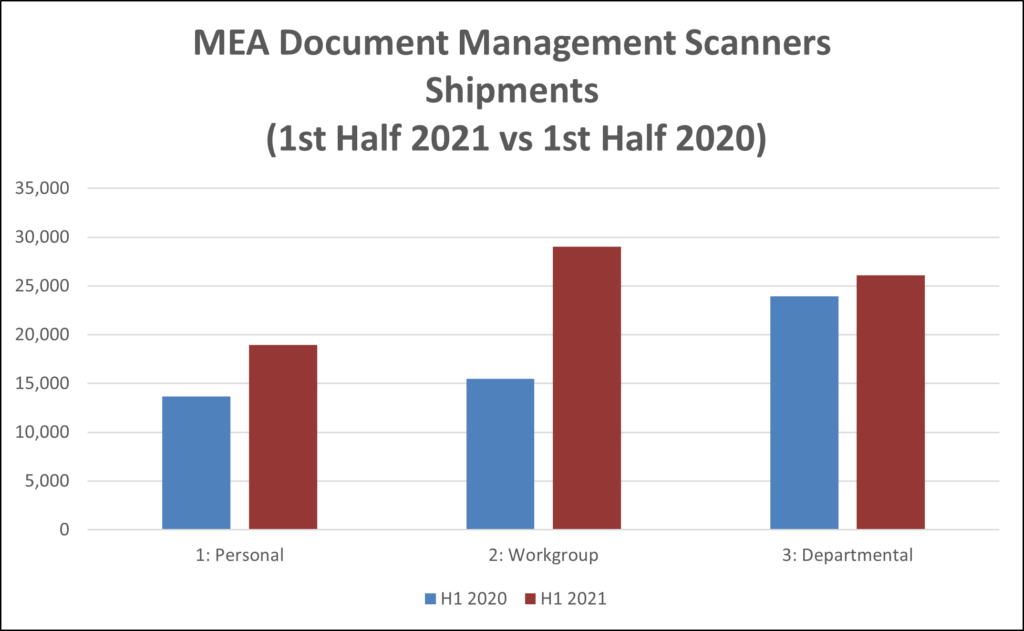

MEA:

Across the Middle East and Africa (MEA) the fall in shipments over H1 2020 when compared to H1 2019 was more significant than any other region at 32.1%. However, over H1 2021 the growth in shipments of DMS scanners in the region at 42% has eclipsed all other regions in the world.

This is explained by the initial sharp slowdown in the region has garnered pent-up demand, particularly in the SOHO sector, which has manifested itself in a strong rebound of sales once imposed restrictions on business and travel were reduced.

In contrast to what happened in E. Europe, no one particular brand fared any better or worse than any other brand. Both Hewlett Packard and Fujitsu weathered the COVID storm and maintained their relative sales strength in the region. When considering brand share the relative market positions of Fujitsu and Brother remained unchanged.

Interestingly, and distinct from the other European regions, it was sales of Workgroup scanners, a category of device dominated by both Hewlett Packard and notably Epson (both brands accounting for approximately 50% of total sales) that drove the recovery in the region over H1 2021

North America Document Scanner Q2 2021 RECAP

This section of the report will cover the sub-regions of North America and Latin America.

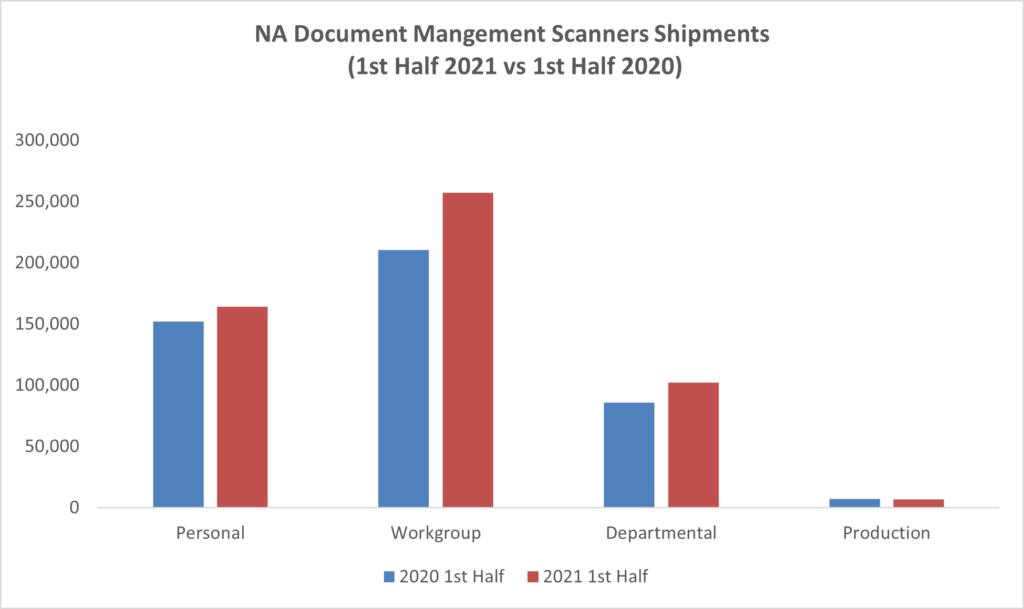

North America:

Overall, in the first half of 2021 document scanner shipments were up 14% compared to the 1st half of 2020 in North America and most vendors showed positive growth from a year ago during this period. In terms of market share, Fujitsu was the market leader with (33.6%) share followed by Epson with (30.6%) share and Brother with (14.7%) share. In the U.S. market, scanner shipments grew (12%) in the 1st half of 2021. Canada shipments grew 34.2% during the same period. Furthermore, all distributed scanner segments showed double-digit growth compared to the same period a year ago, as shown in figure 4 below.

Segment Overview

Shipments of Personal scanners in North America were up 7.4% compared to a year ago at this time. Epson is the market leader in this segment with 42% share followed by Brother (28.2%) share and Canon with 11.1%. In Q2, Canon’s sales grew 27% from Q1 2021 primarily due to the success of the popular ImageFORMULA R40 document scanner model. Additionally, the Workgroup scanner segment grew from 210,299 units in the first half of 2020 to roughly 257,037 units in HY 2021; up 18% year over year. Epson, Fujitsu, and Brother are the top three brands in this segment class.

While the Departmental scanner segment rose 16% from the same period last year. Fujitsu is the market leader with 71.4% share followed by Avision and Canon. Top models in this segment include the Fujitsu fi-7160 and Avision AN 360W scanner. Infosource forecasts 9.0% growth in distributed scanner shipments through the end of 2021. The distributed scanner segment’s rebound in the first half of 2021 can be viewed as more of a correction from pre-Covid shipments. The pandemic accelerated the shift to digitization efforts in the marketplace along with the remote worker/hybrid office trend, one that will continue once the pandemic ends.

While total shipments of production scanners in North America declined roughly 5.6% compared to the first half of 2020 as the effect of the pandemic continued to impart this market segment overall. In terms of market share, within the Low-Volume & Mid-Volume Production categories; Fujitsu, Canon, and Kodak Alaris are the top market leaders. In the High-Volume Production category, Kodak Alaris and IBML are top brands. The pandemic continues to impact this market segment as well as the growing shift from back-office to front-office scanning and workflow solutions.

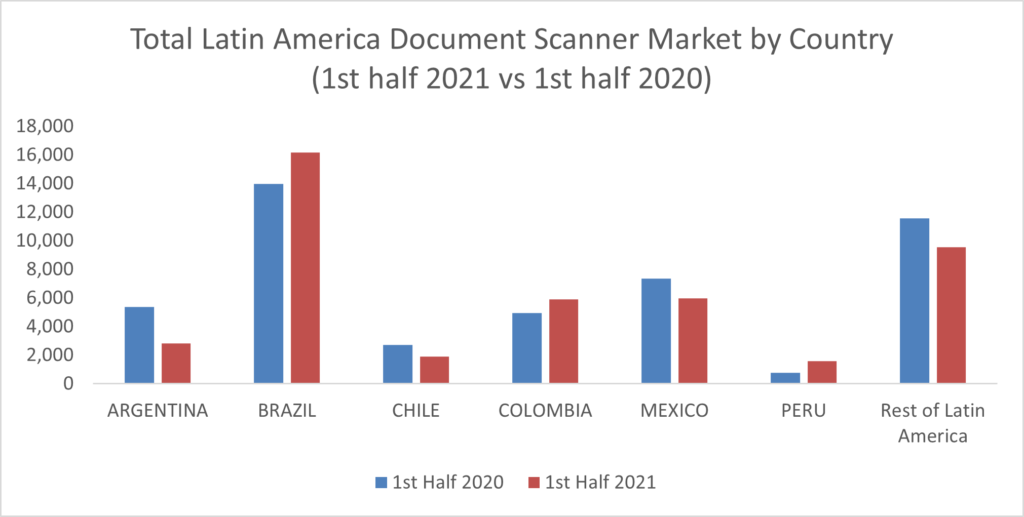

Latin America

Meanwhile in Latin America, the total scanner market declined 6.4% compared to the first half of 2020 While the overall market was down from a year ago, there were some brands that had positive growth. In the personal segment, Brother, Canon, and HP scanner shipments were up compared with the first half of 2020. Additionally, Fujitsu, HP, and Canon Workgroup scanner shipments were up from a year ago at this time. Compared to a year ago, Columbia, Brazil, and Peru all showed positive growth in scanner shipments (see figure 5 below). Overall, there were several inhibitors to growth such as the availability of vaccines and the speed of the distribution rollouts, along with geo-political economic pressures in this region.

Asia Pacific Document Scanner H1 2021 Recap

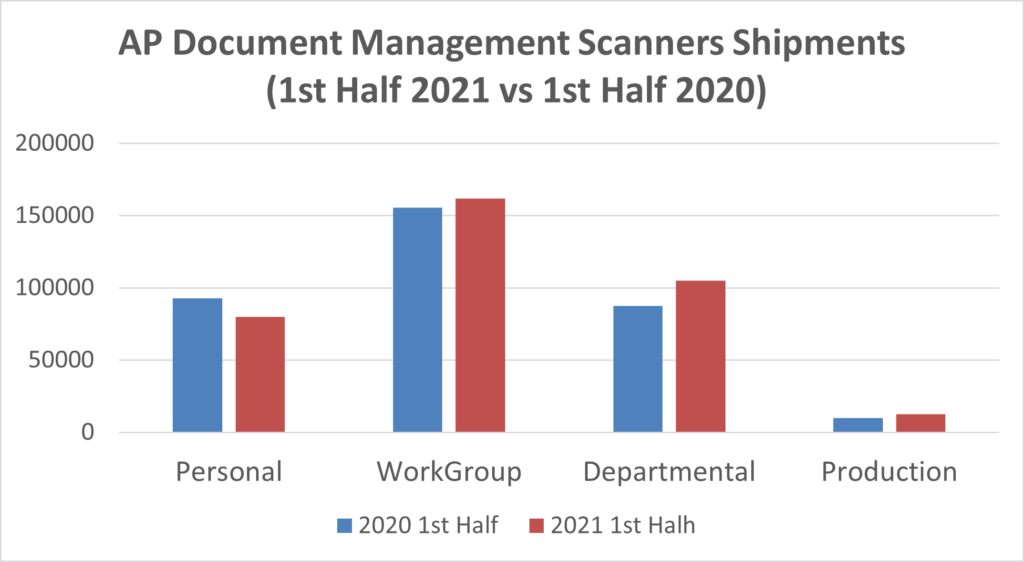

Overall, in the 1st Half document scanner shipments were up 3.91% compared to 1st Half 2020 in Asia Pacific and most vendors showed positive growth when comparing to a year ago during this period.

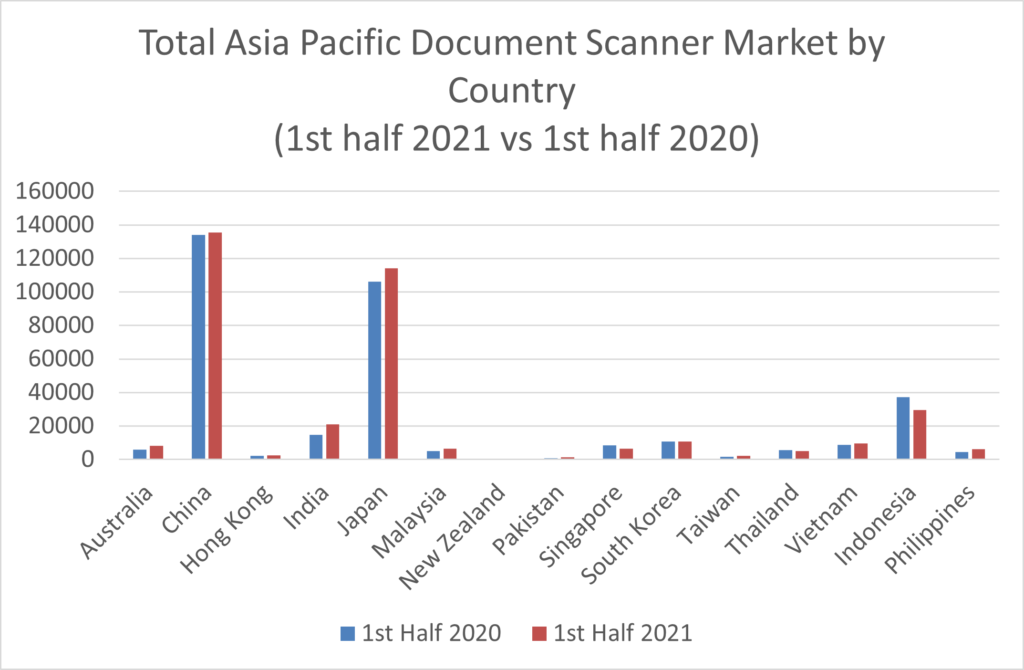

Since China and Japan are by far the largest countries in terms of shipments, when looking at the overall trend in terms of shipments, the trends in these two countries are strongly reflected in the Asia-Pacific figures.

In terms of market share, Fujitsu was the market leader with 32.9% share followed by Canon with 19.9% share, and Epson with 17.9% share. Historically, the volume of shipments during the first half of the year tend to be lighter than the second half. Although total shipments were down overall there were some brands that showed positive growth in H1 including Canon, Brother, Avision, HP, Plustek, and Kodak Alaris. In terms of category characteristics, Personal scanners declined whilst all other segments showed growth.

Segment Overview

Shipments of Personal scanners in Asia Pacific declined by 11.0% compared to a year ago over the same period. In Japan, China, Singapore, and South Korea, remote work has been recommended since early 2020 as a measure to prevent the spread of COVID-19, and there has been a special demand for personal scanners for home use, but in H1 2021, that special demand has subsided, and demand for personal scanners has decreased compared to the previous year.

Epson is the market leader in this segment with 32.3% share followed by Canon’s 19.9% share and Fujitsu with 18.7%. Over H1 2021 Canon’s sales grew 49% from H1 2020, primarily due to the success of the popular P-215II and P-208II document scanner model.

Additionally, the Workgroup scanner segment grew from 136,630 units in H1 2020 to roughly 145,500 units in H1 2021 up 6% year over year. Fujitsu, Epson, and Canon are the top three brands in this segment class. While the Departmental scanner segment grew 18% from H1 2020. Avision, Canon, HP, and Kodak Alaris showed positive growth over H1 2021. Top models in this segment include the Fujitsu fi-7140 and fi-7160 scanners.

In terms of the production scanner market, LV, MV, and HV unit shipments were up 31% compared to H1 2020. Fujitsu, Kodak Alaris, and Canon are the top three brands in this segment class. The growth in production scanners is assumed to be a reaction to the rapid economic recovery in China and the trend of COVID-19 coming to an end, which suppressed investment last year.

Looking at changes by country, all countries except Singapore, Thailand, and Indonesia have shown steady growth against the same quota of the previous year. In particular, Australia, India, Pakistan, Taiwan, Malaysia, and the Philippines showed high growth of more than 30%, with India growing by 42%, Taiwan by 38%, Australia by 33%, and Malaysia by 32%.

Infosource Insight

The objective at the beginning of this article a key objective was to establish whether the DMS market was recovering. Analysis of Infosource’s recently published data we can say conclusively – YES (on the whole). The only exception to this is in Latin America a region in which over the first half of 2021 the DMS market has declined by a further 6%.

| REGION | GROWTH H1 2021v H1 2020 |

| W. Europe | 16.7% |

| E. Europe | 11.5% |

| MEA | 42.0% |

| North America | 16.4% |

| Asia Pacific | 5.9% |

| Latin America | -6.0% |

The table above shows that the level of recovery across the regions has not been uniform. Within the largest DMS markets, North America and W. Europe, the rate of recovery has been relatively consistent; this being largely explained by the parity of vaccination programs and thereby businesses getting back to normal across the regions.

By far the most impressive recovery has taken place in the Middle East and Africa region. Early implementation of disease controls has generated a pent-up demand for product which when combined with successful vaccination programs and a more rapid easing of travel restrictions has produce this impressive market growth.

The authors of this post are Infosource’s:

Mark Nicholson, Regional Manager ([email protected])

Shinichiro Oda, Regional Manager, Asia Pacific ([email protected])

Barbara Richards, Senior Analyst ([email protected])