KEY TAKEAWAYS

- The demand for Capture & IDP solutions in the EMEA region grew at a double-digit rate in 2022 and exceeded 2 billion US$ based on end customer investments.

- The demand for the automation of transactional business processes continued to increase, fueled by the shortage in skilled staff and increasing customer expectations following the pandemic.

- RPA vendors continue to strengthen their IDP capabilities as they expand into the automation of transactional processes involving semi-structured and unstructured business inputs.

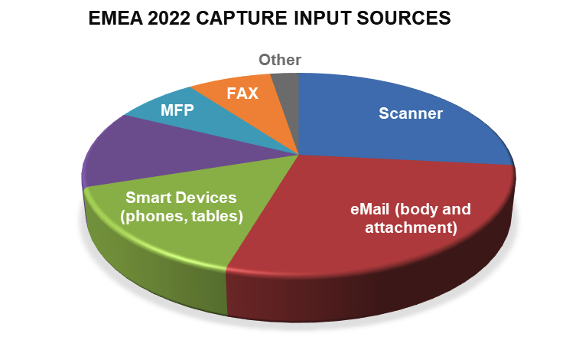

- The input sources related to the digitisation of paper-based business inputs i.e., scanners, MFPs, and fax machines remained stable in 2022. The market growth, however, was driven primarily by digital business inputs, in particular email inputs with attachments and secondarily mobile devices.

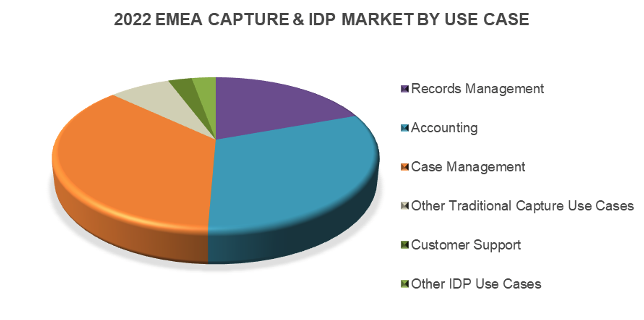

- The market demand for Capture and IDP solutions continues to shift to business applications that automate business transactions, with Records Management being an important but secondary use case. The largest and growing use case is Case Management, such as onboarding and claims. Accounting type applications represent the second largest use case group with a growing demand for end-to-end automation.

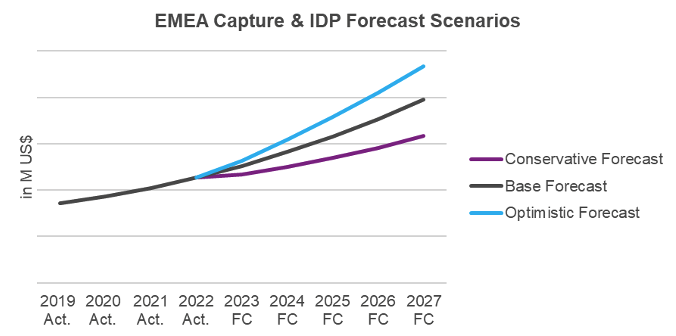

- For the Capture & IDP Software market in the EMEA region, Infosource predicts an accelerated growth of end customer investments in the next 5 years. AI-based solutions and subscription-based services will lower the barrier to entry for process automation and meet requirements for improved customer experience and employee satisfaction. This market dynamic will cause an accelerated shift in the vendor ecosystem, caused by a strong demand for IDP solutions as well as content management solutions including AI-based analytics.

CAPTURE & IDP MARKET FRAMEWORK

Infosource defines the market scope of Capture and IDP Software as solutions and services used to process business inputs which involve unstructured and semi-structured documents and other input types. Business inputs have increasingly shifted from paper to a variety of digital sources arriving via a broad range of communication channels including email, fax, smart devices, and social media. Inputs can include not only documents and other text-based sources, but also voice, photos, videos, and IoT channels.

All inputs are interpreted to understand the content, and where and why it is needed. Data is extracted, validated, and augmented to create the required information for a business process related to an Accounting Workflow, Case Management type applications, to comply with Records Management requirements or to fulfill analytics or discovery needs. Our market assessment includes Capture & IDP solutions ranging from point solutions for document digitisation, to capturing inputs for compliance, to the end-to-end automation of business processes.

HIGHLIGHTS OF THE CAPTURE & IDP MARKET DEVELOPMENT IN 2022

The Capture & IDP Software market in EMEA grew at a double-digit rate in 2022 to over 2 Billion US$. If we consider the negative impact of the exchange rate of the EUR on our reporting currency USD, the market recovered close to pre-pandemic levels.

The market growth was driven by a combination of demand for Intelligent Capture solutions, IDP solutions offered by RPA vendors and increasingly solutions offered by AI start-ups. The interest in process automation continues to be strong in EMEA, causing the demand for Capture-related RPA solutions to increase materially. These solutions represent a growing business element for RPA vendors, who continue to expand their focus to automate comprehensive transactional processes that require the ingestion of semi-structured and unstructured business inputs.

We expect a continued convergence of the different types of Capture & IDP solutions consisting of Intelligent Capture solutions based on Imaging Technology (either as standalone solution or as part of a broader Content Solutions and BPM portfolio), AI based platforms and IDP solutions offered as element of RPA solutions. These solutions target largely the same use cases and offers increasingly overlap due to mergers & acquisitions, partnerships, and technology expansion.

PRIMARY USE CASES

Infosource analyses and forecasts the demand for all Capture & IDP solutions deployed in a given year by primary use case.

The market demand for Capture and IDP solutions continues to shift to business applications that automate business transactions, with Records Management being an important but secondary use case. We saw the highest growth in demand in 2022 in Case Management type use cases, which include business applications like onboarding and claims. This use case segment expanded their position as largest use case group in the EMEA Capture & IDP market. Accounting type applications represent the second largest use case group. Demand for Records Management solutions as primary use case grew only marginally in 2022 and now presents less than a quarter of the market demand in EMEA.

VERTICAL MARKETS

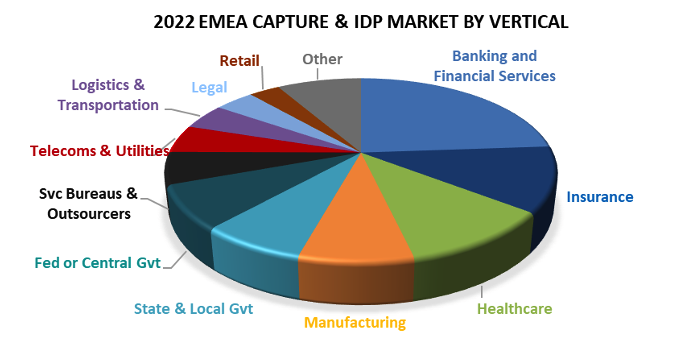

Infosource puts a key focus on the analysis of public and private industries, where we analyse the development of the market demand and forecast the demand for Capture & IDP solutions based on key use cases in these verticals.

In EMEA, the Finance segment, consisting of Banking and Insurance, continues to account for one third of the regional Capture & IDP market in 2022. The Public sector, consisting of Government organisations including Central to State & Local Government agencies as well as grade schools, is the second largest vertical segment in 2022. Healthcare (which includes Pharma) and Manufacturing continue as the third and fourth largest vertical markets in 2022.

CAPTURE INPUT SOURCES

Infosource tracks input sources and devices used for the ingesting business inputs as well as input types as reported by Capture & IDP Software vendors, i.e., reflecting the input sources used by their end customers for new installations.

The pandemic has accelerated the market dynamic of business interactions that shifted from face-to-face to virtual and from analog to digital. This dynamic is clearly visible in the changing mix of input types and input sources during the pandemic years. As COVID-19 ceased to impact the EMEA market in 2022, B2C and B2B business interactions did not revert to pre-pandemic levels related to input sources, they stabilised at a hybrid level, characterised by hybrid environments, like work-from-home arrangements and new habits of virtual interactions.

The input sources related to the digitisation of paper-based business inputs i.e., scanners, MFPs, and fax machines remained stable in 2022 in our assessment of traditional Capture solutions. The market growth, however, was driven primarily by digital business inputs, in particular email inputs with attachments and secondarily mobile devices.

CAPTURE SOFTWARE FORECAST

Based on a comprehensive analysis of market drivers and inhibitors, we see a significant potential for the Capture and IDP market in the forecast horizon and beyond. We predict growing demand for the automation of business processes as well as the increased use of business data to predict demand changes and personalise offers.

In the combined Capture & IDP market we forecast an accelerating double digit CAGR for the forecast period from 2023 to 2027 with a growing demand for IDP solutions offered by RPA vendors.

We expect an increasing demand for Capture & IDP solutions with advanced AI capabilities, i.e., AI-native solutions or imaging-based Capture solutions with significant AI-based capabilities and solutions with advanced automation capabilities. This will drive an accelerated growth in demand for the IDP market.

INFOSOURCE CAPTURE SOFTWARE DIVISION

Infosource is the leading analyst firm for Intelligent Capture and IDP Software market analysis and consulting with more than 20 years of experience in this field.

This blog post is an extract of the 2022–23 EMEA Capture & IDP Software Market report, one of the elements of the Infosource Capture Software analyst services. It provides an in-depth assessment of the Capture and IDP software and solutions market with actuals through 2022 and forecasts through 2027.

Please contact Petra Beck at [email protected] or +491704567908 to discuss how the Infosource Capture & IDP Services can help you grow your business.